How Mortgage Rollovers will Rollover You and the Economy

Your loan can be fixed or adjustable/variable. This is usually not a major issue in normal times. But we don't live in normal times.

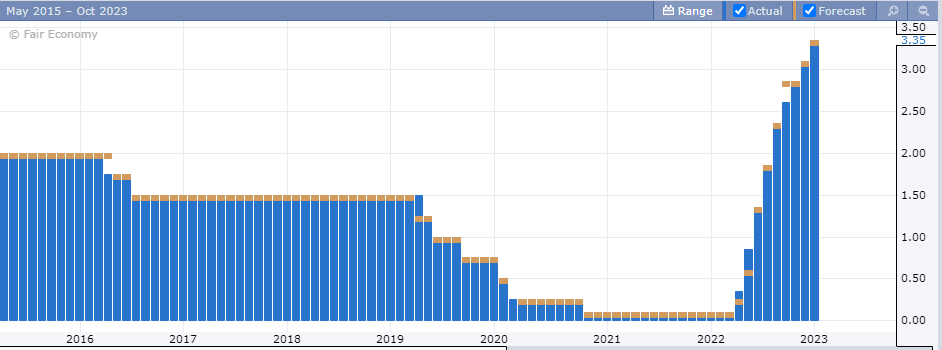

As expected, the Reserve Bank of Australia raised rates by 25 Basis Points on Tuesday. This brings the Interest Rate to 3.35%. We are a few hundred points more expensive when it comes to borrowing.

This image shows the mammoth increase seen in the span of one year. The United States is, in a way, seen as a thought leader for the West regarding Central Banking policy. No doubt Governor Lowe was watching closely when Governor Powell decided to raise the cash rate in the United States.

But this is common knowledge and is information that provides no edge or benefit to you. You can read about rate hikes anywhere. Our focus today is on the Mortgage rollovers, which will undoubtedly roll over many families in 2023 and onwards.

The concept is simple, you see a house you like, but as a salaryman, you need some financing to assist in the purchase. You chat with your mortgage broker and either sign up for a Fixed or Variable rate mortgage.

Fixed mortgages have higher upfront premiums and rates, which are locked in. You see the variable rate, which is dirt cheap in comparison and see that this is genuinely the sweeter option.

At this point, the stars haven’t aligned, and COVID, the global recession and the ensuing credit crunch from 2022 onwards haven’t happened yet. All is well in the world, and you are paying 1-3% for your mortgage.

You didn’t read the fine print, which directly tied variable rates to the interest rate + the bank’s premium on top.

But What is a Variable Rate loan?

A variable interest rate (sometimes called an “adjustable” or a “floating” rate) is an interest rate on a loan or security that fluctuates over time because it is based on an underlying benchmark interest rate or index that changes periodically.

This would be a better option, but we haven’t seen 300Bps rate increases globally in 12 months. In essence, credit all over the world is being crunched and battered. In this way, McDonald’s needs to borrow money to make payroll. If there’s no borrowing, there’s no money to pay workers; there’s no Big Mac. Now you aren’t McDonald’s; they can absorb these rates. You… most likely cannot.

But My Interest Rate is Fixed and won’t change for a while

How sure are you of this?

Your rate is fixed, but a term generally used in real estate is “the cliff”. As such many of you may have been insulated from Rate hikes; however, your loan is subject to the same cliff everyone else is.

Most Australians have loans with the BIG 4 banks in Australia. CBA, NAB,Westpac & ANZ. These banks have rollover periods and mortgage schedules when the bulk of the mortgages they hold for customers roll over from Fixed rate to…. you guessed it, Variable/adjustable rates. You will see your rate jump by a few percent.

As reported in CBA’s FY22 results, the bank confirmed that almost 75% of its mortgage book would be exposed to rate increases through June 2023. This includes 61% on variable-rate home loans and 13% on fixed-rate loans scheduled to roll off by June 2023. The bank confirmed that 26% of its fixed-rate loans are scheduled to roll post-June.

By value, CBA’s fixed rate home loan expiry schedule shows $51bn of loans would roll over in the six months to December 2023, with $44bn to roll over in the preceding six months, from January to June. A further $29bn would roll over in the first half of 2024, $24bn in the second half of 2024, and $25bn in the six months to June 2025. A final $10bn of CBA’s existing loans would roll over from mid-2025 and mid-2027. That’s JUST ONE BANK.

Starting to worry? I wouldn’t blame you if you were.

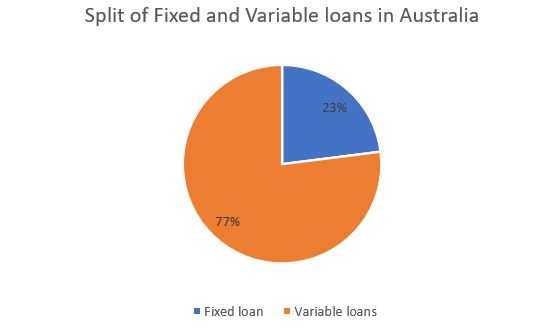

The Reserve Bank of Australia estimates that around 23 percent of all Aussie home loans worth almost $500 billion are fixed and will switch to variable rates by the end of 2023. That means there is almost AUD 2.17 Trillion worth of Variable rate loans already subject to Interest rate fluctuations.

So the question is, why is the RBA still doing this?

There is no simple answer. However, in summary, it is a race against time to curb Inflation and a potential recession in 2023 by curbing the effects of unfettered borrowing for the last decade. And it seems they’re willing to take a baseball bat to some mortgages to do it. See below for a deeper look at interest rate policy.

What can you do?

We’re not doomers. However, we cannot provide financial advice. We are solutions based, and what we can do is educate. If you or someone you know has a mortgage, ASK your broker about your rollover period and see when your variable rates kick in. Budget accordingly and try to get in front of it. Common logic claims that the more of your mortgage you pay earlier, the less you will pay in interest and principal payment 10 years later. In essence, the more you pay in advance, the less exposed you may be when you can’t predict your mortgage.

Get ahead of your mortgage before the rollover rolls over you.

Stay Safe.

🗡️Thank you for reading our work and supporting our message🗡️

Can you please define this “cliff”? Was that in the mortgage contracts the buyers signed? Or is this some obscure option the banks have in Australia, and the buyers didn’t know?