Crypto: We are so Back(ish)

BTC is pumping. Let's look at on-chain, technical, macro, and fundamental data to see what could happen in the next few months

We wanted to wait till the dust settled a little bit before jumping headfirst into a breakdown of what’s been happening in the cryptocurrency space over the last few weeks.

It’s been crazy. Unless you’ve lived under a rock, you would have seen BTC pop up on your social media and trading software. All of a sudden, everyone is claiming they saw this coming. We call these people hindsight traders and charlatans. Unless you were the hedge fund(s) who watched the issuance of the BTC ETF ticker on the CFTC and promptly removed it, you would have missed it. Let’s see what you missed.

If it wasn’t painful enough, aside from pumping 23% recently, BTC is up 112% YTD. How did we get here? I thought crypto was dead. It was, now it isn’t. Here’s the brief for the lazy people.

Summary:

BTC bottomed out at USD 18,000 in 2023

it has consistently put in Higher Highs and Higher Lows in 2023 (Yellow circles)

It has failed to break below the VWAP the entire year. (high momentum)

It broke past its last key point of consolidation on May 22 and held above it.

However, this is hindsight bias. What we will now do is go through the technical and fundamental factors affecting BTC and then try to find a roundabout way to a prediction. DEEP BREATH. Here goes

NOTE: Our analysis is purely based on data and actionable info. Not some moron coming out of the woodwork to sell his course. It is challenging to put together, and we have day jobs. This is free Alpha. Consider subbing.

Real Technicals (not lines on a chart)

Lines on a chart mean very little. We need to read between the lines here. We do not give a shit about Twitter. We need to see where smart money is placed.

By looking at the:

Open Interest: Number of open contracts on the market

Funding Rate: An exchange mechanism to ensure Spot price is in line with Futures price(penalizing Longs/shorts if price strays either way too heavily)

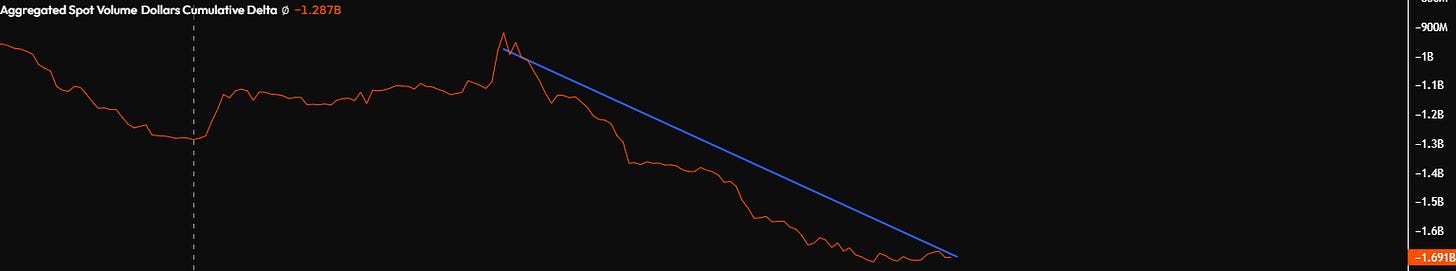

CVD Spot volume: The number of spot buying/selling on the asset.

Spot Price

BTC Price is now in consolidation. Think of a spring. The longer it is coiled and the tighter, the more violent and intense the subsequent movement will be. Be it a move up or down. Boring; No value here. If you want chart analysis, go elsewhere.

CVD Funding

Funding is an exchange function that tries to keep the Futures price of stocks, crypto, or even soybeans in line with the Spot price. Think how the price of BTC on Coinbase or Kraken is often Below/Above the price on Bybit or Binance. If you’re holding a long and the market is long-biased, then the price may deviate too high from SPOT. Therefore, funding rates are paid to your counterparty, the shorts, to try and close the price difference. (when funding is positive). Shorts are paid for the penalty of being short in a biased market.

At this moment, Funding is heavily positive however, this will vary based on exchange. However, this means that exchanges are paying Shorts as they need to ease pressure on the price.

The solution is either to increase the spot price or decrease Perp prices to cool down the market. No clear signal yet.

Open Interest

OI measures nothing more or less than the number of new contracts being opened in a market. It does not matter if they are longs or shorts.

At this point, there is a net increase in the number of contracts being opened in the market. Essentially, what this means is two things.

Either:

There is a net increase of Longs; or

Net increase in shorts

This by itself means nothing, but coupled with the increase in positive CVD, it means that there may be a net increase in short contracts entering the market over the past few weeks, keeping the market suppressed for the time being. However, crypto can be irrational, so keep your wits about you.

Spot Buying

When we say spot buying, we don’t refer to what your E- Girlfriend or mate at work buys. Here, we do aNALysIs.

What we see here is the spot buying in aggregate on BTC. What we have seen previously with OI is the futures market; however, we must also look at how BTC is performing in the spot exchanges like Coinbase, Kraken, etc. to get a more holistic picture.

What I see concerns me. There is a surge of Futures contracts that are being opened, which have a 60-70% of being large shorts, and on the flipside on the Spot market, we are seeing a net bleeding out of spot buying indicated by the scary downtrend in volume. Money is leaving the spot market.

Quick note: Any move made in the next few weeks will likely be a futures-driven move, and unlike spot, futures-driven moves are twice as violent, so watch your back.

now for the scary part….lol

What is the smart money is doing

This is the Chicago Mercantile Exchanges breakdown of the makeup of BTC positions on the futures market. You won’t delve too deep, so I’ll simplify.

Think of it this way:

Dealers: hedge funds/Market Makers/Institutions (heavily short)

Asset Managers: Greyscale/Vanguard/Blackrock (long only)

Leveraged Funds: mid-market / prop funds (Heavily short)

Other reportable: Retards/Twitter CT/ You (Heavily Long)

Hey, at least you have the same market bias as Blackrock. Good for you.

WRONG!!

Blackrock and Vanguard position themselves in decades, not months. They have been accumulating over the years. You haven’t. It is likely the only thing holding BTC up at the moment is these large asset managers buying up slowly and hiding their tracks. This won’t appear on the spot buying indicator as they haven’t been buying in my chosen timeframe.

I am very concerned in the short term but VERY BULLISH in the long term. But make no mistake. The smart money believes that the price shock of the BTC ETF has been absorbed and priced in.

The Fundamentals and Macro

I wanted to skew this to a technical understanding of BTC as it can provide more short-term information to our readers. However, having a background in Macro, I have written consistently about how, in my opinion, the market is waiting for Interest rates to either cut or be held in place to start a new cycle run.

I said in an article months ago.

“our short-term prediction is a global jump in market sentiment if rate hikes pause, hinting at a new day that a sudden uptick will follow in Inflation. This will worry Powell and his counterparts worldwide, and there may be a handful of rate increases to drive Inflation down and make it manageable in the long run. Then, we will finally see rate cuts in EOY 2023 and a brighter Q4 2023 - Q1 2024.

You must be well-placed to capitalize to take advantage of the next boom. You can make mistakes for cheap as markets are slow. You can test yourself now and learn how markets operate.”

Most of what I said has held. The only caveat is that rates are being held firm till this year. But cuts will only be accepted long before they bleed out the economy.

Read Below for reference.

But how are the FED rate holds related to BTC

Price is everything. I won’t bore you with data, but long story short. Even a hold in the Interest rate for the past two months led NOT to a depression in BTC but a price jump. Imagine what happens to one of the greatest assets once rates begin cutting in 2024. I got your attention now, haven’t I? The market is ready at the macro level. Save your money; you’re gonna be busy in 2024.

Breaking News: (Labour market it F#cKed)

the US economy added 150k jobs in October, down from a negatively revised 297k and well short of expectations of 180k, whilst previous months' results were also negatively revised. The unemployment rate unexpectedly rose by 0.1% to 3.9%, with the participation rate unexpectedly falling 0.1% to 62.7%. Finally, average hourly earnings data was mixed with MoM at 0.2% (0.3% expected) and YoY at 4.1% (4.0% expected).

Powell is taking notice. A weak labor market is the result of high Rates and Inflation. As cruel as it sounds, Powell is watching closely as lower wages, lower employment, and unemployment inadvertently put downward pressure on Inflation. It's a cruel balancing act. This is one of the reasons why rates have not been as aggressive in the last few months.

TLDR: High Unemployment + Low Inflation = Potential Rate Cut = Crypto 100x wen lambo

So what do we do?

There are two scenarios. BTC makes new highs by the end of the year, and you miss out. OR

BTC capitulates to the massive short interest, and you miss out but think you were smart for waiting, OR

You DCA.

You play the long game and begin accumulating at various price points. Accumulate small parcels of large caps like BTC and Eth all the way to bullshit your mate told you about, like HarryPotterSonicObamaInu. (Yes, it exists).

Conclusion

The market is like the Letter U. The left side is the bear market of late 2023/2023, and now we are coming out of the right side of the curve. We are not in the parabolic state of markets yet. The surge in shorts piling in means we may chop around/or go to 60k tomorrow. I DON’T KNOW. What I do know is that based on the law of averages, the 2024 approval of the BTC ETF, the shift in market sentiment, the pump of BTC on the back of rate hold news, and the fact that I’m retarded means…. I am short-term bearish on BTC but long-term insanely bullish. DCA slowly and build your bags, not for tomorrow but for the next 18 months. But like I said earlier, it ultimately all comes down to U.

Let’s make some money :)

Thank you for reading our work and supporting our message🗡️

Thanks for the info, very informative.

Another bomb article