Bear Markets Breed The Best Bulls

We are in a global bear market at the moment. Brown bear, Polar Bear, Yogi bear. let's see when Ferdinand the Bull will drop by

Since the rate hike mission begun by Central banks around the world almost a year ago, we have seen a global crunch in credit, liquidity, and stonks. Everything is down as the cost of borrowing has skyrocketed, and we still have high inflation levels to put a bow on it.

You would have seen a very flashy sales guide last week, but we primarily post on very nerdy macroeconomic material. Today we will try and predict the next bull market and most likely fail too.

Background

A few months ago, we predicted that the pain could only last for so long. Markets could only take so much pain before they began caving in. In one article, we outlined how the mortgage cliff was fast approaching, where the bait and switch from Fixed rate to Adjustable rate mortgages in Australia would affect over $500B worth of mortgages. If you want to have a more solid understanding of how we got here, read below.

We said it was possible that Central banks around the world were beginning to understand that rampant inflation was a long-term issue that would have a degree of stickiness. Ultimately poor and risky assets would be the first to be cut. And then SVB collapsed, and soon after, we saw IB behemoths UBS and Credit Suisse teeter on the brink. But by economic standards, this is now modern history. Even if the RBA paused rates and the FOMC followed, what exactly does this mean for you, and how can you capitalize?

TECH IS SEXY, BUT IT IS DEAD

We have ONE overarching rule for you. Find the vacuum and Fill it.

You MUST zoom out from individual stocks, crypto, commodities, and fashion industries to cultivate your thesis. We cannot give financial advice and are not pretentious enough to say this information is gold. All we can do is follow my nose and write about it occasionally.

Although Covid is in the rearview mirror, the ensuing supply chain crisis and its effect on markets remain. You need to look at out-of-favor assets and industries which are not in the news. When you buy a ramping tech stock, you will most likely be someone else’s exit liquidity.

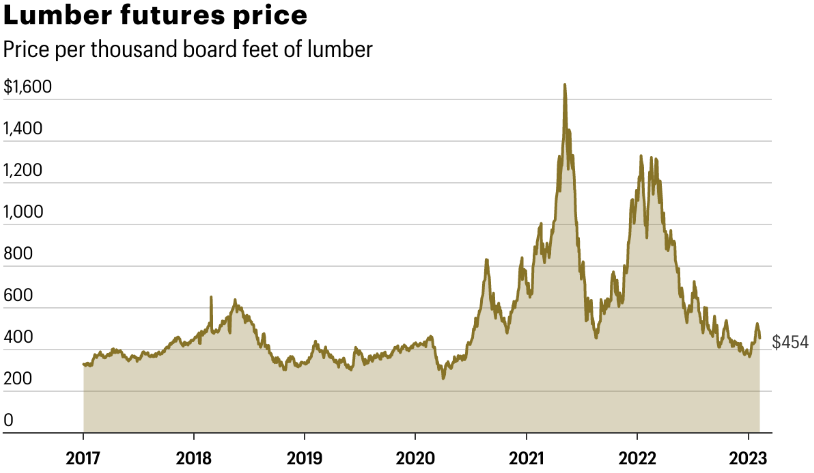

Industrials, Manufacturing, Chemicals, and hospitality are industries to look out for. Covid hammered these industries, and unlike drop shipping clients, the supply chain crisis meant lumbar importers were not getting their wood on time. Therefore creating a severe Imbalance between buyers and sellers. Sellers called the shots, and wood was gold at one point.

You must look at industries still suffering from supply chain shocks, trading at consistent lows, and having a history of resilience. Tech companies are a dime a dozen; that timber company in your neighborhood has probably been there since 1850. In short, look deeper if it’s listed, survived Covid/Inflation, and is printing quite profits. They may not be 20x in 2 years but may be 5x in 5 years.

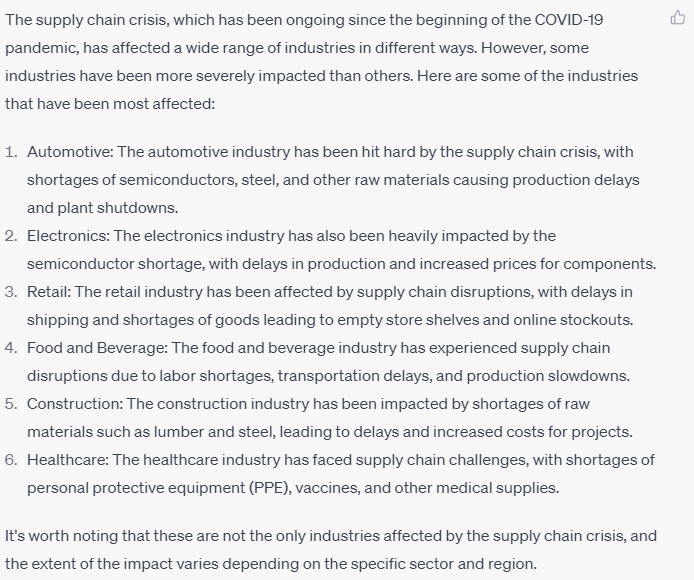

Your money is precious; don’t blow it on leveraged call options for Tesla… Also, use Chat GPT. See what a quick search yielded:

Treat the market like it’s 2009

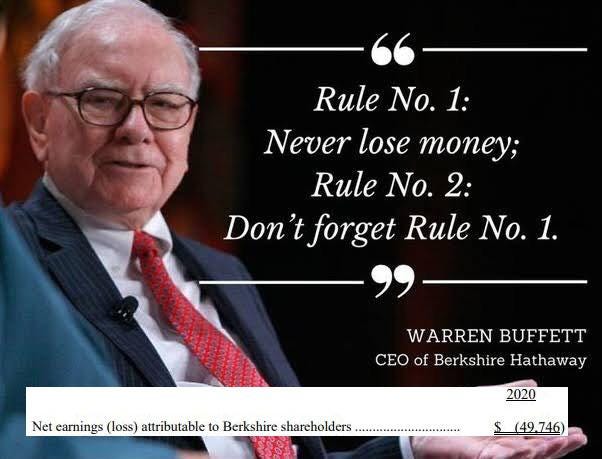

All those Warren Buffet quotes about blood in the streets are relevant now. Don’t just hang wallpapers of the fella. Apply his tactics.

Equities are trading at all-time lows, and there is blood on the streets. That stock you saw trading at 100x during the stimulus cheque area will most likely be trading at cost. Obviously, apply the knowledge above and find sectors out of the news. As lame as it sounds, researching the global price of Timber and platinum will provide more insight than a 30-minute guru video on youtube.

One possible line of thought to follow. When Lumbar was expensive, Manufacturing and Homebuilding equities suffered as it was a seller’s market. However, as lumbar prices stabilize, more and more companies will be able to source raw materials and produce more whilst trading on low share prices.

Learn How To Actually Invest

You must do the hard yards. We are currently doing this. YOU WILL NOT LEARN STOCKS on Social media. This knowledge is found in textbooks and spreadsheets. The most basic thing you must learn is how to read financial statements: the income statement, the balance sheet, and the profit & Loss statement. Supplementary knowledge includes analyzing market-sensitive announcements and their effect on stocks. Examples include the Vesting of shares, new deal signatures, new product releases, and notable resignations.

If you can also learn how to read order flow, you will be in better hands than 80% of traders; however, this is incredibly complex, and you are going up against proprietary and High-Frequency Traders. Here’s a piece of advice for free. Bots will outpace your trading in short time frames. HOWEVER, algorithms and GPT cannot digest financial information in longer time frames and make judgment calls. Although some funds will probably find a way to do this, the layman will be tricked into thinking his chatGPT prompt represents an accurate historical perspective of how certain markets performed. It does tend to make stuff up when it has no idea what to output. This is why we like to invest long-term and not day trade.

Conclusion

To wrap it up, our short-term prediction is a global jump in market sentiment if rate hikes pause, hinting at a new day that a sudden uptick will follow in Inflation. This will worry Powell and his counterparts worldwide, and there may be a handful of rate increases to drive Inflation down and make it manageable in the long run. Then we will finally see rate cuts in EOY 2023 and a brighter Q4 2023 - Q1 2024.

You must be well-placed to capitalize to take advantage of the next boom. You can make mistakes for cheap as markets are slow. You can test yourself now and learn how markets operate.

Because trust us, you’ll be too busy making money in the bull run to be reading accounting textbooks.

Happy Hunting.

And remember…

Thank you for reading our work and supporting our message🗡️

In Australia, there is a super-inflationary driver that goes unrecorded, therefore unfactored, because economists and demographers rely on official and /or conventional markers/data. I consider this to be foolish, especially as the past three years has taught us never to trust official explanations.

Land prices, especially arable and residential, have been sucked into a wild thermal that nobody explains convincingly. I have recorded the process previously but was slapped back with "foreign land ownership records refute your claim that Chinese have been buying up big".

Let me just say, that anybody who does not understand that the FIRB was established to lubricate foreign buy-ups, should not be in this conversation. Most Chinese purchases, made with CCP funds, were made by Chinese Australian citizens, therefore, of no interest to the FIRB.

This is how it was done: In 1975, the US planned and funded an Indonesian invasion of North Australia. The general who constructed the invasion plan smelled a rat when he found no estimate of logistical costs. Recognising that if the US would arrange the invasion of its 'bestest friend' Australia, it would surely betray Indonesia as well. So he arranged for a logistical analysis and was shocked to discover that the expense of advancing through 1600 ks of waterless, foodless, fuelless, desert, would anhilate the Indonesian economy.

Thus, he understood that the US game plan was to weaken both nations in order to more easily control them. He cancelled the invasion. However, 90% of corporate Indonesia is Chinese, and so word was instantly conveyed to China resulting in termination of any similar plans and, instead, Plan B was formulated.

Word of the Tiananmen Square massacre was proselytised world-wide and CIA agent, Prime Minister Bob Hawke immediately announced that 22,000 Chinese students would be given Australian citizenship as a means of protecting them from the 'evil CCP'.

It is understood that 22,000 increased dramitically and these are the invasion force currently taking over the valuable component of the Australian land mass. Obviously, this is inflationary but is not factored in because it does not officially exist.

Two items of history need to be recognised. The first is that the invasion logistics were known to both the US and Australia in the1940s, resulting in what was known as The Brisbane Lince. The sacrificing of the north in order to destroy any advancing enemy. The 1942 evacuation of the NT was pursuant to this strategy.

The second item is that we do not need the US to protect Australia. Our cruel and vast landmass does this very well. Ironically, the only nation with a will to capture Australia militarily, is the US, which it is doing as we speak, There are now 12 military installations in the NT alone, invited in by a government that has been owned by the US since the sacking of the Whitlam Government in 1975.

All discussion about investment and potential prosperity is academic until we reclaim national sovereignty.