Why Bitcoin is not Secure - An Analysis of the Bitcoin Security Model

A detailed analysis describing why Bitcoin's security model is a looming threat for the top Cryptocurrency... yet no one seems to care

TLDR; If you plan on buying, setting and forgetting for a decade+, choose Ethereum

Part 1: Story Time

Imagine a mysterious hooded man approached you one day with a simple choice:

“Liquidate every asset you own, and choose a single cryptocurrency”. “I will cryofreeze your body for 100 years, and wake you up after a full century has passed”

You, an avid Dan Held worshipper, decide to liquidate everything you own, buy Bitcoin, dump it on a hard wallet, and then get the old hooded man to freeze you. The plan is genius. You wake up in a more futuristic world, ultra-rich and live like a king, forever, because humans would have probably figured out how to cure ageing.

A century passes, and the cryo-chamber defrosts your lifeless body. You're awake. You feel the ledger in your pocket, it’s safe, and you have made it 100 years in the future with all your precious Bitcoin. You search frantically for a chart or price, asking people for the price of Bitcoin.

But something is wrong. They all give you weird looks.

“Bitcoin?” They reply, surprised, “why would you want to know the price of Bitcoin?”

Anxiety sets in. You will find one of the free computers now common in 2123. You don’t have enough social credits to use the machine, but a kind stranger lets you use his computer for a second. You look up “Bitcoin”.

Shock.

“The Bitcoin network suffered yet another catastrophic 51% attack today. The network has been upgraded to remove the 21m hard cap to keep income for miners sustainable; however, the rocketing price of energy made it difficult to secure the network.”

The price of 1 BTC = 10 future bucks. But inflation was so high 10 future bucks couldn’t even buy you a ticket to use the transport tube. You cry, shouting at the heavens. How could this happen, you think?

Now you are poor, in an unfamiliar timeline, and have your beliefs of Bitcoin being the “hardest money” shattered. Dan Held lied to you. You walk down the street and see a government building that says “Cryo-people Help Center”. You walk in, hopeful. It turns out you weren’t the only one the mysterious hooded man visited. A whole bunch of people entered this new world with nothing.

The machine at the counter (which has replaced all human support workers) scans your brain.

Education: None

IQ: MID

Physical Capabilities: Low

Dan Held and other Bitcoin maxis told you not to go to college because it was a scam. They told you the gym was also a scam. They told you to spend all your money stacking sats. You feel like an idiot.

The machine lights up, printing out what seems to be an application form. It speaks, in a robotic voice:

“Only profession experienced for: Soy burger flipper”

1 year has passed in this new world. You spend your days flipping soy burgers for the low class whilst your colleagues make A5 wagyu steak burgers for the WEF (World Economic Forum) followers.

Suddenly, you see him. IT’S THE HOODED MAN! You run out of your wagie cage and confront him.

“You destroyed my life!” you mutter. “Why didn’t you tell me to buy Ethereum? All the WEF elite became trillionaires because of Ethereum!”

The hooded man starts to cackle manically, his face still hidden under his large cloak.

“You fool! he mutters. It’s your fault for being a Bitcoin maxi simp and not doing your diligence! this is your punishment until you die, after which your body is recycled to make the “soy” burgers, to feed the wagies”

The hood slips off. Your mouth drops. The hooded man is none other than Vitalik Buterin!

Part 2: The Importance of Strong Security

The above story was mainly because the author of this article enjoys shitposting. However, it does serve a purpose. It is to explain why having a sustainable, economically secure security model for Cryptocurrency networks is essential.

Security is important for a blockchain network because it is designed to ensure the integrity and immutability of the data stored on the network. This is achieved through cryptographic techniques such as hashing and digital signatures, which allow for secure communication and the creation of tamper-proof records of transactions.

Ensuring that network operators like nodes and miners make sufficient revenue for securing the network is crucial because it ensures that there is a sufficient incentive for them to participate in the network. Network operators may choose not to participate without adequate incentives, leading to a lack of decentralization and increased vulnerability to attacks.

Therefore, the revenue generated by network operators through transaction fees and block rewards is critical to ensure their participation and commitment to the network's security.

Hence, security is essential for blockchain networks because it ensures the integrity and immutability of the data stored on the network. Adequate revenue for network operators is crucial because it ensures that there is a sufficient incentive for them to participate in the network, which in turn ensures a sufficient level of decentralization and security.

Part 3: Incentives (Show me the Money!)

Fundamentally, a blockchain network’s security comes via a security budget paid to miners/node operators etc. These rewards usually come from block rewards and on-chain transaction fees.

The issue is, however, a balance needs to be struck. Architects of these systems need to figure out how to keep miners/node operators paid whilst not inflating supply. This is no simple task.

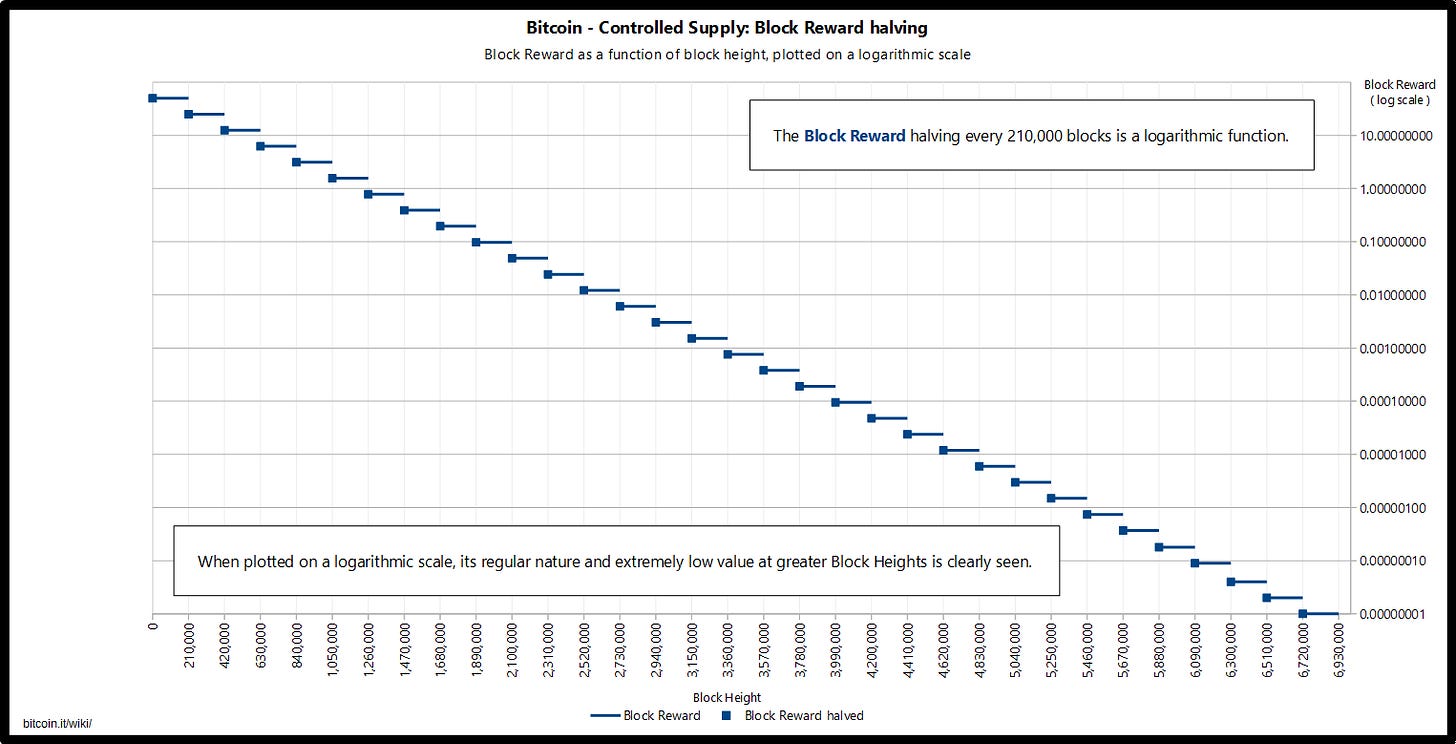

Bitcoin tackles this by halving block rewards every 4 years or so, with the original vision being that, eventually, transaction fees pay for the difference in block rewards.

This was stated in the Bitcoin whitepaper:

“Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free”

Of course, Satoshi made a colossal assumption when originally designing the Bitcoin protocol. They thought it would be used for payments, but these days Bitcoin is more akin to digital gold, meaning most people do not often send transactions. Instead, most transactions either occur off-chain or on other cheaper networks, like Layer 2 networks or Tron etc.

Let’s look at the numbers:

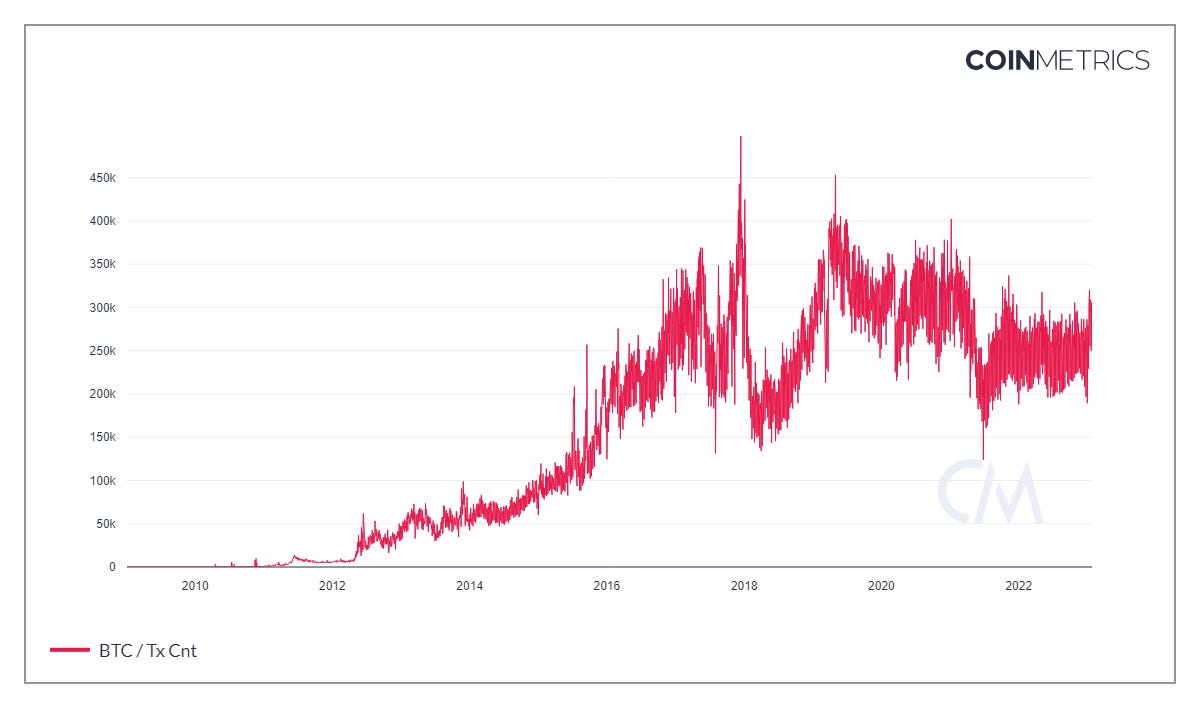

Bitcoin Transaction Count:

The above chart has been trending down since the 2018 peak. Even though Bitcoin created a new high after the 2017-2018 bull run, it still struggles to make all-time highs in transaction count. If this trend were to continue over the next decade, it would mean miners would make decreased revenue over time (in Bitcoin terms), which would not offset the block reward, as described by Satoshi in the original whitepaper.

Miner Revenue (Bitcoin):

We will discuss miner revenue in USD later on; looking at miner revenue denominated in Bitcoin helps us understand if Satoshi’s assumption was correct; transaction fees will replace block rewards post-halving. Well, the chart is pretty straightforward; it does not. Miner revenue in Bitcoin has been on a downtrend since the top in around 2011 and does not seem like it will recover, with every halving cycle dealing another blow to miner rewards.

Looking at both of these charts is pretty damning. Why aren’t Bitcoin maximalists more worried about the security budget of Bitcoin if it’s been on a constant downward trend since 2011? Well, that leads us to our fourth part…

Part 4: Security Model Ponzi Scheme

Although miners mine BTC, they need to sell that BTC for USD in order to pay for energy, mining equipment, taxes and so forth. This means that a miner’s revenue can be broken down into the following equation:

Miner Revenue = Bitcoin price (USD) x Units mined

Why is the Bitcoin price in USD important? Well, many energy vendors and chip manufacturers don’t pay Bitcoin, so miners need to liquidate Bitcoin to float the whole business.

In order to make the Bitcoin security model less Ponzi-like, the “units mined” side of the equation needs to keep going up.

Breaking down the equation even further, units mined can be broken down into:

Block rewards x transactions fees

Since block rewards half every 4 years, transaction fees paid by the network users need to fill in this void.

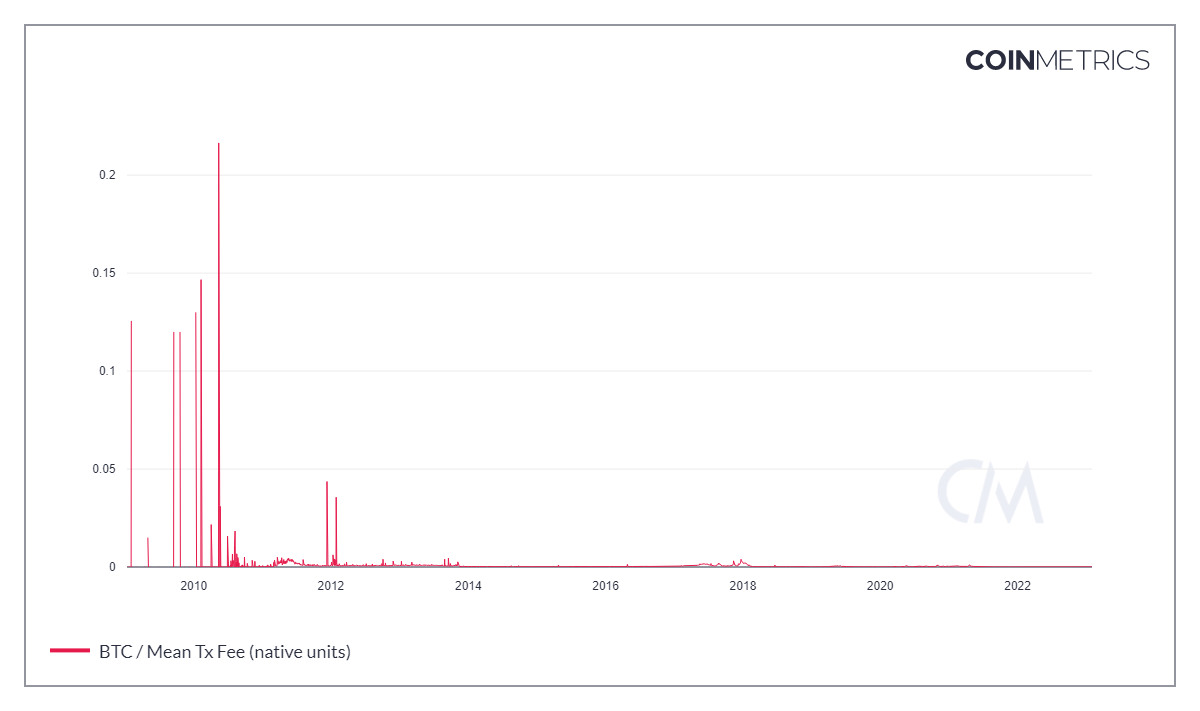

What about transaction fees? well… the data isn’t looking great for that as well.

The mean transaction fee has also been on a downtrend, primarily because of users using the network less over time, as the narrative changed from money to store of value.

You might be thinking right now, if miners are making less Bitcoin every year, how are they still making so much money? Well, the answer is pretty straightforward, bull market.

The above represents miner revenue in USD.

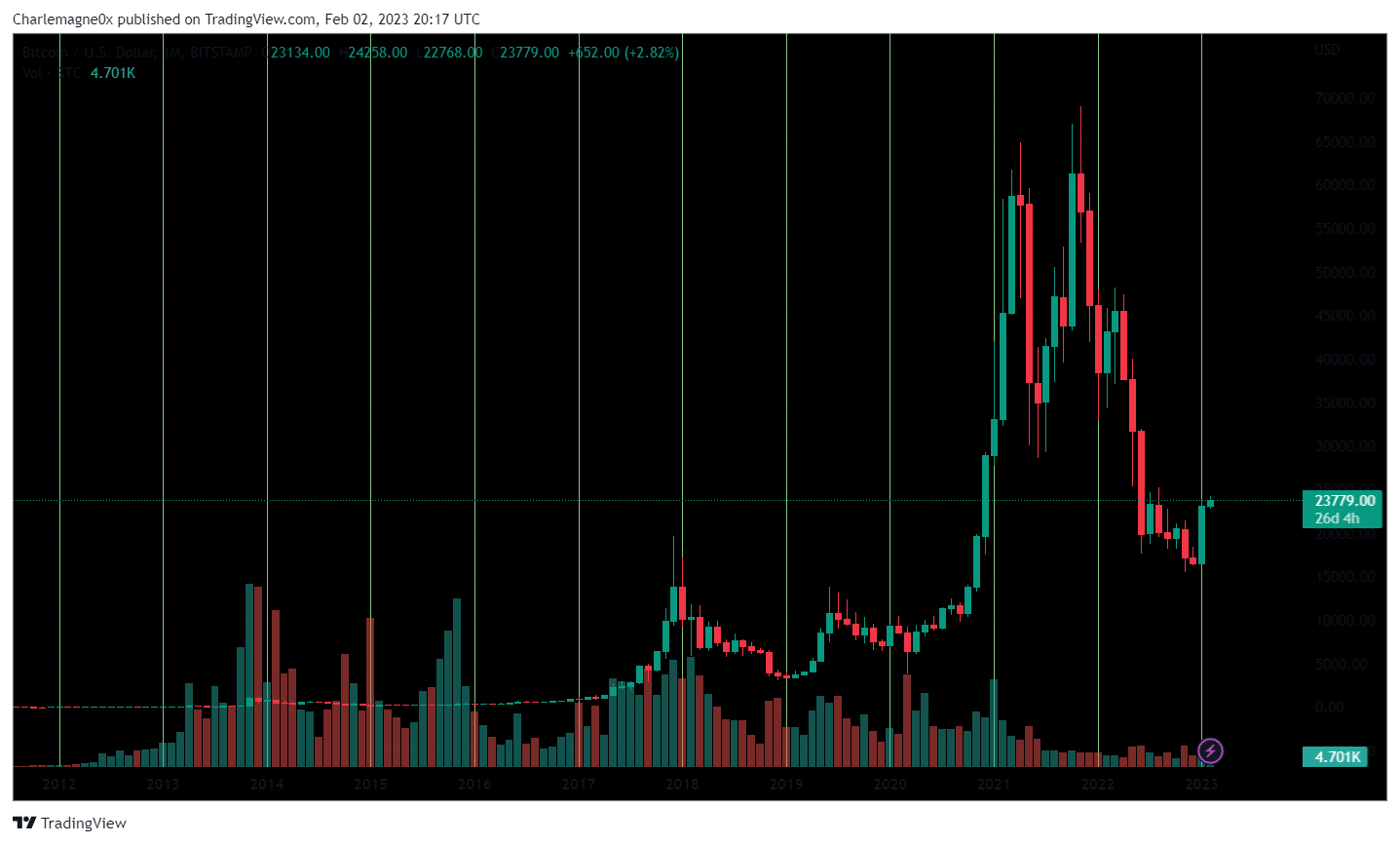

The above is the price of Bitcoin since its inception.

Now the whole picture is clear. One part of the above equation is heavily skewed: the Bitcoin price in USD. This means even though miners are making less Bitcoin, the decade-plus-long bull market has meant the security model issue has never been a problem.

Returning to our short story, what happens if you wait 100 years? Would Bitcoin keep going up forever to sustain the constant increase in resources to mine less and less Bitcoin?

Put simply, any asset which requires the price to go up forever is unsustainable and effectively a Ponzi.

Basically, suppose you plan to hold Bitcoin for a few more decades. In that case, you need to have absolute conviction that the price keeps going up and Bitcoin never faces a prolonged bear market, which will slowly cripple the network's security, eventually opening it up for attack.

Part 5: Fixing the Security Model

Well, we have established that Satoshi’s original thesis was incorrect. On-chain transaction fees clearly will not be enough to sustain miners. So how can the Bitcoin fee mechanism be fixed to ensure miners keep getting paid to secure the network?

Part 5.1: Ethereum

The best way to describe how a sustainable fee model would look on Bitcoin is to look at a network that has effectively solved this problem. Ethereum.

EIP-1559, or Ethereum Improvement Proposal 1559, is a change to the Ethereum network that addresses some of its scalability and cost issues. It modifies the way the Ethereum network processes transactions and sets gas prices, which are fees paid to miners for processing transactions and executing smart contracts.

The critical feature of EIP-1559 is a new mechanism for setting gas prices, which makes the network more efficient and less congested. Previously, gas prices were set by users, and during times of high demand, they could increase significantly, leading to slow transaction processing times and high fees.

With EIP-1559, gas prices are now set by a base fee, which adjusts based on the current demand for processing transactions. The base fee is adjusted dynamically in real-time based on the number of transactions waiting to be processed and the available capacity of the network. This ensures the network can process transactions in a timely manner, even during periods of high demand.

However, the feature of EIP-1559 you should care most about is the introduction of the "burn mechanism", which allows a portion of the gas fees paid by users to be permanently removed from circulation. This reduces the supply of Ether, the native cryptocurrency of the Ethereum network, potentially stabilizing its value.

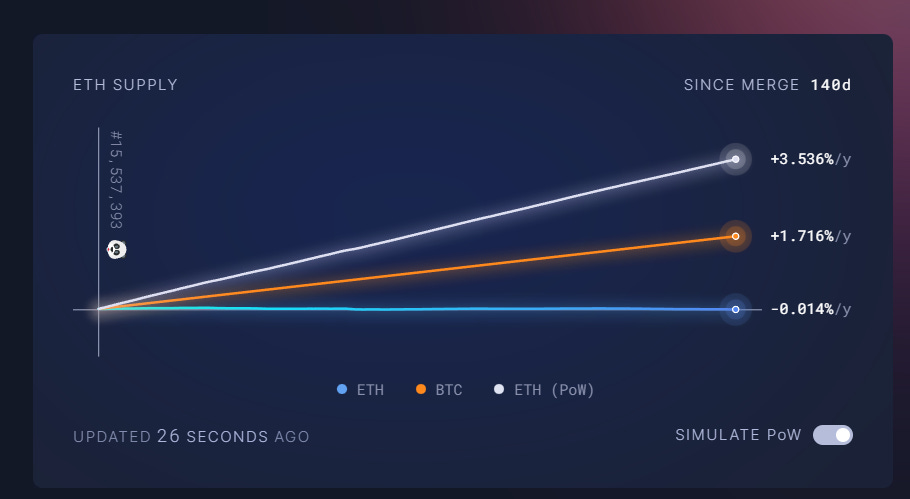

This basically means block rewards never end, which ensures a sustainable revenue model for Ethereum validators. However, to keep supply at equilibrium, transaction fees are burned. This essentially means in times of high usage, Ethereum becomes deflationary, and in times of low usage, supply increases, allowing for a dynamic and robust market for users.

Since the introduction of Proof of Stake and EIP-1559, Ethereum’s net issuance has been down, whilst also ensuring the chain is secure against attacks. This is what a perfect security model looks like.

EIP-1559 is an important step forward for the Ethereum network as it addresses its scalability and cost issues and makes it a more efficient and user-friendly platform for decentralized applications and other use cases. Bitcoin core contributors would do their best to learn from how this was implemented and potentially implement it if the security issue becomes a serious problem.

Part 5.2: Adding a Tail Emission

Of course, this would be seen as heresy from the Bitcoin camp and require a hard fork (to remove the 21m BTC limit). However, it could secure the network whilst keeping supply somewhat sustainable due to lost coins.

Peter Todd wrote an excellent paper; we will summarise his thoughts and reasoning below.

The paper examines the relationship between cryptocurrency issuance and inflation. Todd argues that tail emission, the continued issuance of new cryptocurrency units after its initial release, is not necessarily inflationary.

In traditional economics, inflation is defined as an increase in the money supply that leads to a decrease in purchasing power. However, Todd argues that this definition doesn't accurately reflect the economics of cryptocurrency, which operates differently from traditional fiat currencies.

Todd argues that tail emission in cryptocurrencies is not inherently inflationary because the supply of cryptocurrencies is not constant and is determined by the network's consensus rules. Todd claims that tail emission is not always inflationary because it depends on the overall demand for the cryptocurrency and the mining power used to secure the network. Further, the loss/destruction of coins can help to keep the supply at a stable equilibrium. However, it’s important to note this number is hard to predict as it’s impossible to determine what percentage of the supply is lost forever.

Todd also states that tail emission can be seen as a reward for participating in the network rather than as a form of inflation. In this view, tail emission is a way to incentivize miners to continue participating in the network, which helps maintain network security and decentralization.

Overall, Todd concludes that tail emission in cryptocurrencies is not inflationary and is a reward mechanism to incentivize network participation. Todd argues that this view offers a more nuanced understanding of tail emission in cryptocurrencies. It can be helpful in evaluating their economics and potential impact on the broader financial system.

Part 5.3: Generating Demand for Bitcoin Blockspace

Bitcoin operates on a priority fee gas model. The Bitcoin priority fee gas model is a fee mechanism used in the Bitcoin network to prioritize transactions. Transactions in the Bitcoin network are processed and confirmed by network participants, called miners, who prioritize transactions with higher fees.

In the priority fee model, transactions are prioritized based on the fee size attached to them, with higher fees being processed first. Transactions with lower fees may be delayed or not processed at all, depending on the current demand for block space and the network's overall capacity.

Users can attach a fee to their transaction when sending Bitcoin, with fees measured in satoshis per byte (the smallest unit of a Bitcoin). The fee size attached to a transaction affects its priority in the network, with more expensive fees generally leading to faster processing times.

Miners are incentivized to prioritize transactions with higher fees because they receive them as compensation for processing transactions and adding them to the blockchain. This creates a market-based mechanism for allocating block space, with users paying higher fees to have their transactions processed more quickly.

If demand for Bitcoin backspace goes up, the equation we demonstrated above can be rebalanced so miners can earn more, meaning they need to rely less on the price of Bitcoin in USD to keep the network secure.

How can demand block space be increased?

Drivechains

The first and most obvious solution is building robust layer 2’s/drivechains on top of Bitcoin. A Bitcoin drivechain is a type of blockchain technology that is designed to operate as a sidechain to the Bitcoin network. A sidechain is a separate blockchain linked to a parent blockchain, such as Bitcoin, and can transfer assets back and forth between the two chains.

The purpose of a Bitcoin drivechain is to provide a way for Bitcoin users to move their assets off of the main Bitcoin blockchain and onto a separate chain for a specific use case or to take advantage of certain features. For example, a drivechain could offer faster and cheaper transactions and more privacy or support decentralized applications (dapps).

Drivechains work by creating a two-way peg between the main Bitcoin blockchain and the drivechain. This peg allows users to transfer their Bitcoins from the main chain to the drivechain and vice versa and ensures that the same amount of assets exist on both chains at all times.

The drivechain concept was first proposed by Paul Sztorc in 2014 and has since been developed into a number of different implementations. The goal of drivechains is to provide a way for Bitcoin users to take advantage of new and innovative blockchain technologies without leaving the security and decentralization of the main Bitcoin network. Unfortunately, development in this space was not robust, so drivehcains never gained significant adoption.

Bitcoin NFT Ordinals

Ordinal theory gives satoshis individual identities, allowing them to be tracked, transferred, and given meaning as collectible, tradeable digital assets. This can be done without changes to the Bitcoin network and imbues satoshis with numismatic value.

Individual satoshis can be inscribed with unique content, creating durable, immutable, and decentralized digital artifacts that can be stored in Bitcoin wallets and transferred using Bitcoin transactions. However, other use cases, such as off-chain coloured coins, public key infrastructure, and a decentralized DNS replacement, are still speculative and exist only in the minds of some theorists.

These NFT ordinals on Bitcoin have sparked massive interest, with users paying miners high fees to mint their NFTs on Bitcoin. You can view the NFTs being minted here.

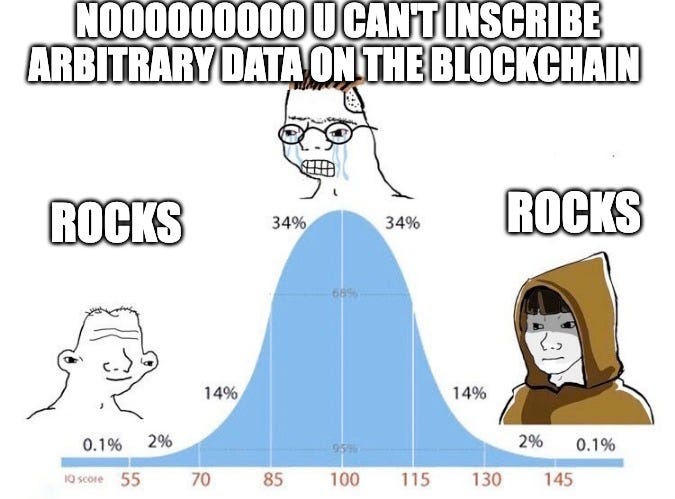

But of course, the typical decenters have come out in force against the idea.

This brings us to our final part:

Part 6: Evolution and Stagnation

The Bitcoin network is not perfect, and its economic model is not sound. This has been clearly established with the over a decade of data we have to prove if Satoshi’s thesis was correct. So what needs to be done? Well, the base layer itself does not need to change much. Upgrading the protocol to support robust layer 2 ecosystems could be the solution to Bitcoin’s security model problem. Although ordinals are great, they are not a long-term solution to the problem, as it is pretty limited. Furthermore, the typical NFT market needs, such as trading, royalties, listing etc need to happen off-chain, which defeats the purpose of using a decentralised chain anyway.

The issue is with the anti-innovators, the hypocrites who unironically believe the network is sound. How can something be referenced as “hard money” when the economic model that is responsible for securing the entire chain is uncertain? This means the foundation of the Bitcoin protocol is shakey and could be ripe to attack if a significant enough miner capitulation was to evolve.

The Bitcoin community has been brain drained and taken over by literal religious cultists who think the protocol is too “pure” for advancement. There are even attempts to censor ordinal transactions from nodes, and talks of soft forks to remove the functionality completely. Of course, the Bitcoin maximalist community are no stranger to mid-curve takes.

Put simply, if the community cannot evolve and adapt the network to solve this problem, Bitcoin is a much riskier investment versus, say, Ethereum, which has a provably stable and robust economic model to ensure validators are always paid to secure the network.

🗡️Thank you for reading our work and supporting our message🗡️

Bitcoin has both a faulty security model and a faulty monetary model.

Since Bitcoin is deflationary it can never replace fiat currency, since an actual economy run with a deflationary currency would soon produce almost no goods (consumers would wait for prices of goods to go down, producers would expect lower sales and reduce production = economic death spiral ensues). So BTC can mostly be used as "digital gold", which means few transactions, low tx fees, until soon the network becomes unsecure (in 40 years you'd need a BTC market cap of $700T just to have same security level as it has now if txs don't pick up significantly.

There are massive Incentives that are aligned to secure Bitcoin, literally hundreds of billions of dollars.