The Revenge of the Nerds: How Ivy League Rich Kids Fumbled a 10 Billion Dollar Bag

A detailed analysis of the FTX collapse, the players involved, and the impacts on the crypto market and investors

2022 marked one of the most destructive years for the cryptocurrency space, capped off by the collapse of FTX. One of the former largest exchanges in the world, FTX along with its sister company, Alameda, a crypto hedge fund and market maker, have both collapsed.

There are many reasons why this occurred, including hubris, greed, arrogance and potential cult-like connections which make the story seem strange but also help to shine a light on how corrupt large parts of the cryptocurrency industry are.

A great quote from The Art of War will guide this analysis, to help develop an understanding of the mistakes SBF and his core team made, which resulted in their downfall.

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

-Sun Tzu, The Art of War

Part 1: Know Yourself

In order to understand how FTX and Alameda collapsed, we first must develop an understanding of the characters involved in this saga. Although it is fair to say there are many individuals who contributed to this downfall, two core individuals were most likely the shot callers who made the decisions that resulted in the death spiral.

Sam Bankman-Fried (SBF)

Caroline Ellison

SBF and Caroline both had extremely privileged upbringings. They went to private schools, and Ivy League colleges, and were both co-workers at one of the largest funds in the world Jane Street. They also had deeply connected parents, with deep political connections.

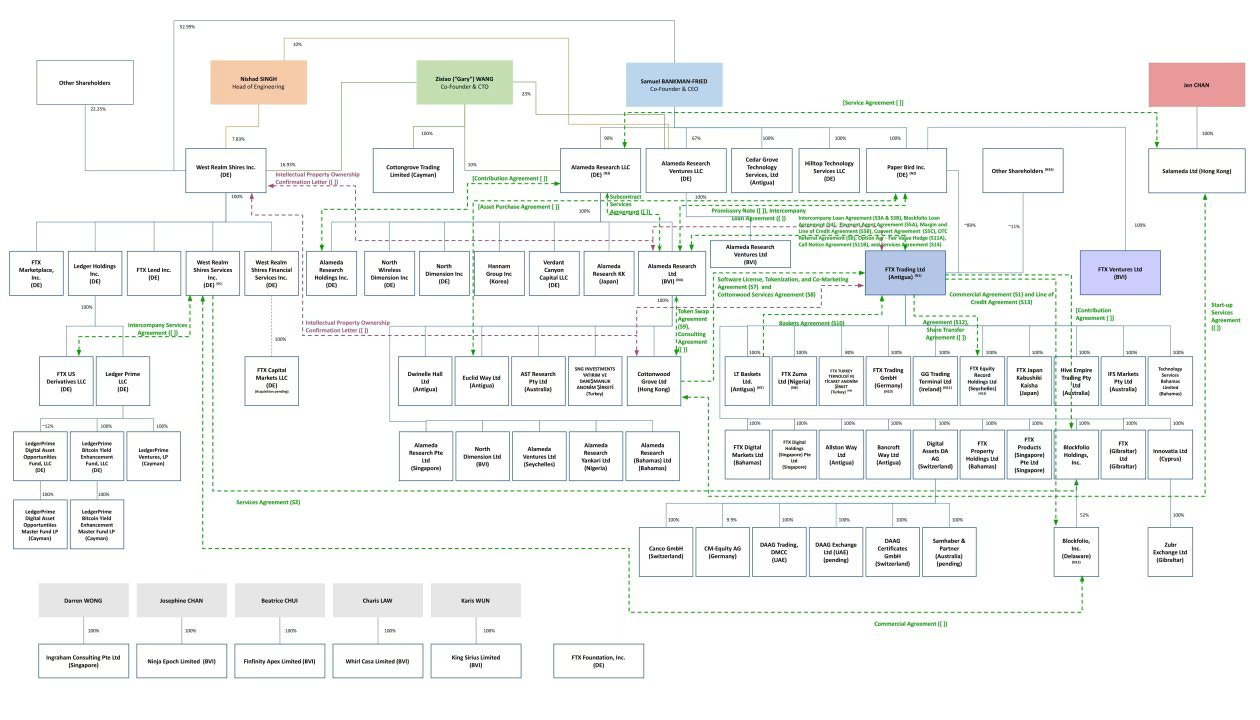

SBF's parents are both professors at Stanford Law School, with his mother being Hillary Clinton’s lawyer. Caroline’s father was Gary Gensler's (current SEC chair) former boss whilst teaching at MIT. SBF’s dad was also an expert on tax shelters, which explains the insane and viral diagram of the FTX and Alameda corporate structure.

Understanding how well-connected, and well-off these individuals are is important. When paired with some quotes from an old Sequoia Capital article (now taken down), it really helps put into perspective why these two individuals made the decisions they did, which led to such a massive collapse.

For some context, one must understand a belief system known as “Effective Altruism”. What EA boils down to is maximising relief in the world through donations, by maximising revenue and profit generation. Essentially, a person following this philosophy calculates what the cost of saving a human life is, and hence how one can produce the greatest returns to save the most humans, as efficiently as possible. Both Caroline and SBF were followers and propagators of this philosophy.

Feel free to read a Twitter commentary thread of one of the writer’s analyses of Sam and EA…

Reading through some of the quotes in the article, it’s easy to understand the mentality and the trading strategy behind FTX and Alameda.

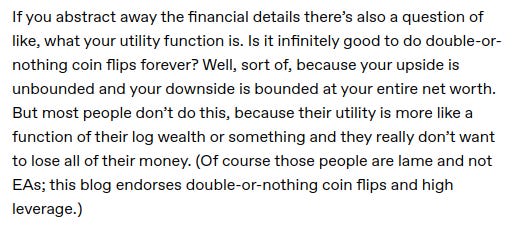

"All of it boiled down to expected value. The formula is fairly simple. If the amount won multiplied by the probability of winning a bet is greater than the amount lost multiplied by the probability of losing a bet, then you go for it—irrespective of units"

This is the first key mistake that SBF made. Although the logic in the statement is sound, SBF is clearly very bad at calculating and conceptualising risk. Alameda and FTX were both mixing funds together, which included client funds. Further, they invested in many high FDV, low liquidity/early stage startups, so exiting these positions in the short term was near impossible.

It gets worse, however. Digging deeper into the article, it further cements the idea that SBF had literally no concept of risk management, and was hence willing to gamble away funds if he thought the move was +EV.

"To do the most good for the world, SBF needed to find a path on which he’d be a coin toss away from going totally bust"

Reading this initially was shocking, yet validated a large part of our thesis. Running a large exchange in itself is extremely profitable. FTX saw billions in trading volume a day across its products and could have well-funded many altruistic causes. However, SBF clearly wanted more. The irony of this is that FTX and Alameda were both most likely built on shaky foundations, as leaked screenshots from a pitch deck show them offering institutions massive returns, with, in their own words “virtually no risk”.

The red flags were clear, and yet, investors still piled in. Digging even deeper, it’s obvious the EA movement was a lot more than just a philosophical movement.

“His course established, MacAskill gave SBF one last navigational nudge to set him on his way, suggesting that SBF get an internship at Jane Street that summer”

It’s very clear that this MacAskill character, the founder of the EA movement, had a massive impact on SBF and drove him towards trading the markets. SBF also donated a large portion of his trading revenue to MacAskill’s EA charity, among others. Further, when SBF quit Jane Street, he went on to work as the director of business development at the Centre for Effective Altruism (MacAskill’s charity). A simple question to ponder; why would a charity need a head of business development?

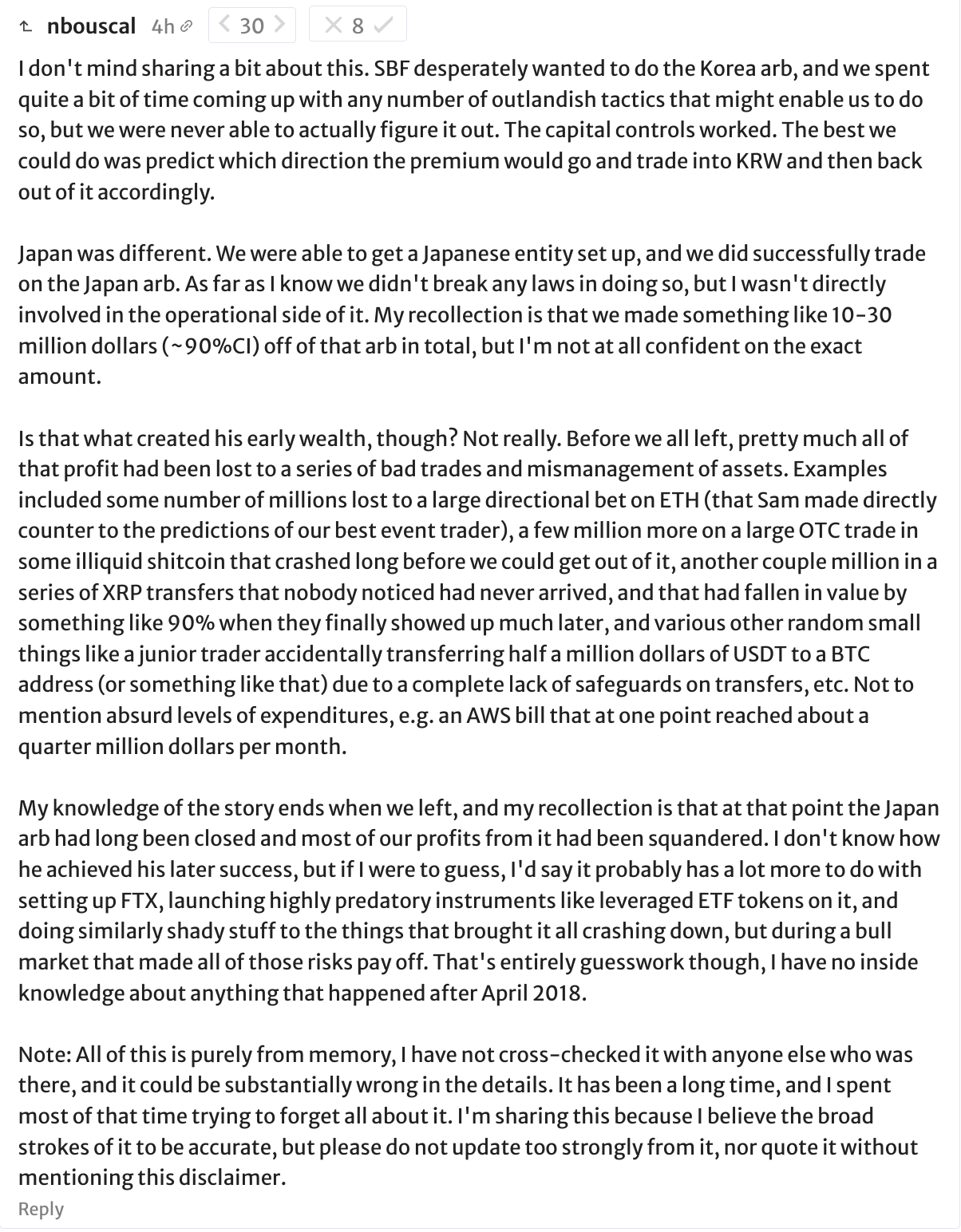

Moreover, the common story told on how SBF earned his early wealth was by arbitraging the “kimchi premium”. The kimchi premium was simply a dislocation in the Bitcoin price between some Asian countries like South Korea and Japan, with the price usually trading higher on exchanges in these countries versus the rest of the world. SBF simply had to buy BTC on non-Asian exchanges, and sell on exchanges located in Asia. However, there was a problem; SBF could not access accounts in these countries. This was solved by reaching out to his connections in the EA community and using a Japanese citizen in the community to access these exchanges and execute the arbitrage. It’s surprising how SBF had basically everything he ever needed to succeed at his fingertips.

Interestingly, a member of the EA forum who was familiar with this strategy and SBFs and Alameda’s revenue gives a different account of what actually happened with the Kimchi arbitrage.

What’s more insane is how one of the co-founders of Skype lent SBF 50 million USD to increase the size of his positions. Again, someone he met through the EA community. It starts to seem like SBF’s empire was engineered by other powerful people and not by him directly. For someone who was pretty much unknown in the space until very recently (in the crypto ecosystem) his extreme rise to fame is suspicious. It seems like some powerful people were engineering a frontman to push their causes into the world, which makes sense when analysing how fast SBF shot to fame globally.

His partner in crime, Caroline, also had a very similar belief system to SBF, when reading through her Tumblr blog, which was recently discovered, it adds more depth to the character of the people running these billion-dollar organisations.

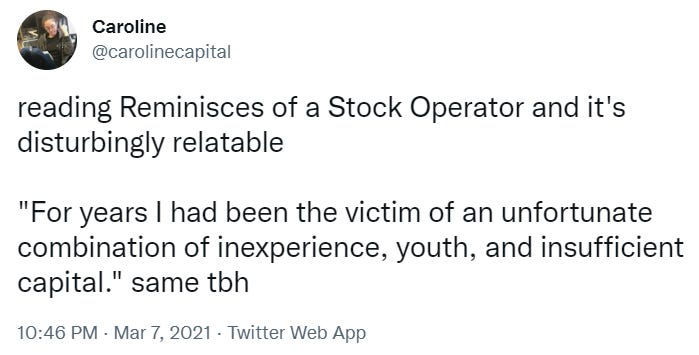

Exhibit A:

Exhibit B:

For the uninitiated, the book she references in her tweet was a book written by the famed degenerate trader Jesse Livermore, who ended up taking his own life.

Contextualizing all this information with the added information of leaked documents, really helps us develop an understanding of exactly the kind of strategy SBF and Caroline were running. They had very little risk management, and effectively doubled down every time they took a significant loss, which eventually lead to them using client funds.

This is most likely due to both of them having god complexes and being extremely narcissistic. Their privileged upbringing most likely contributed to their “higher than thou” attitude, thinking with their education and connections, they were effectively bulletproof. However, as another famous crypto VC who was wiped out said;

“Those who do not manage their risk will have the market manage it for them”

Zhu Su, co-founder of 3AC

This character analysis would have been enough, but a couple of hours after finishing this section, the New York Times published an article interviewing SBF. The article further strengthens the points made above. SBF and Caroline are clearly both extremely narcissistic individuals with god complexes, which ultimately is what resulted in their empire crumbling to nothing.

Some choice quotes; In response to posting cryptic tweets (displayed below), SBF simply remarked, “It’s going to be more than one word,” he said. “I’m making it up as I go.” So he was planning a series of cryptic tweets? “Something like that.”

But why? “I don’t know,” he said. “I’m improvising. I think it’s time.” Clearly, this individual lacks the empathy to understand the magnitude of his actions. It’s fair to note however this could be a dead man’s switch, but at this point, this is all speculation.

To summarise this segment, our character analysis makes the following clear:

SBF and Caroline are both highly narcissistic individuals. Clearly, the effective altruism movement was a means for them to both gain money and power.

Both have a serious god complex, throwing away even the most basic risk mitigation strategies, and extending as much leverage as possible.

Both have a serious lack of empathy, destroying many innocent investors, funds and even projects after forcing them to custody funds on FTX (with both SBF and Caroline knowing full well they plan to use these funds unethically).

Even though they both have advanced degrees in math or physics, went to Ivy League schools, have well-connected parents and basically have lived a life of complete luxury and ease, both are clearly extremely bad traders lacking in risk management and positioning knowledge.

Ultimately, their massive god complexes, thinking that because of their parentage and education they are above the basic laws of the market. They were firmly reminded that the market does not care about a person or group’s background or knowledge, if you violate its rules, it will liquidate you.

Based on the analysis, it also seems like they are both puppets for a higher power. However, this cannot be verified but is lent credibility by SBF’s and Caroline’s rapid rise to fame and power.

“He knows nothing, and he thinks he knows everything. That points clearly to a political career.”

― George Bernard Shaw, Major Barbara

Part 2: Know the Enemy

Many people questioned why SBF would start a war with the baron of crypto, Changpeng Zhao (CZ). A quote from the Hagakure perfectly summarises SBF’s position, and why he was essentially forced to fight:

“Even if it seems certain that you will lose, retaliate.”

-Hagakure

When running a Ponzi scheme, a core tenet to keeping the whole system afloat is to ensure that new entrants keep buying in. For SBF, this was achieved by raising more rounds, investing in projects and forcing them to custody their funds on FTX, as well as buying out broke lenders (like BlockFi) and using their customer assets to keep the system chugging.

Of course, this strategy does raise some red flags, which did result in back-and-forth skirmishes between both CZ and SBF. SBF had to retaliate as if he did not, he would look weak, and if he looked weak he would not be able to raise even more money to keep his scheme going. Hence, he embodies the essence of the above quote.

However, this strategy was working. CZ was becoming more vilified in the community, and SBF was being praised by influencers, celebrities, and even congress. But, SBF grew arrogant, and this arrogance was what ultimately led to his undoing.

Let’s run through the timeline of events that led us here, and the exact mistakes SBF made that ended up exposing him.

Chapter 1: Don’t F*ck with DeFi

In crypto, there are some cardinal laws that cannot be broken by new entrants. One of those is don’t try to regulate DeFi. When the Tornado Cash sanctions hit, both Bitcoin and Ethereum maximalists came together against the sanctioning of the protocol and the arrest of its lead developer, which is an extremely rare occurrence.

SBF’s first mistake was not controlling the flow of information. A leaked document outlining the new bill he was trying to push through congress. Gabriel Shapiro, general counsel at Delphi Labs, leaked a draft of the Digital Commodities Consumer Protection Act of 2022, or DCCPA. The bill basically planned to force all DeFi frontends to register as money transmitters, force audits on the industry (audits which are even more strict compared to what the FED has to adhere to), which would effectively kill DeFi, all in the name of “consumer protection”. SBF not only was fighting from a position he could never win from (as he was breaking a core tenant of crypto), but he kept doubling down on his position which drew in more scrutiny.

“Move not unless you see an advantage; use not your troops unless there is something to be gained; fight not unless the position is critical.”

-Sun Tzu, The Art of War

SBF, refusing to back down from his position, was challenged by Erik Vorhees, a crypto veteran, to a debate on the bankless podcast. The debate was thoroughly one-sided, with Erik schooling SBF on the concepts of decentralisation, and why it’s important. The clip below does a good job of summarising how outclassed SBF was.

SBF is clearly a smart individual, in the calculation sense. However, as demonstrated above, he lacks a high level of critical thinking. This made it easy for a skilled and experienced cryptocurrency advocate like Erik to easily dismantle SBF’s facade, and expose really how much of an amateur SBF was in the space.

At this, SBF was losing the respect he spent years, and hundreds of millions of dollars to cultivate.

Chapter 2: The Art of War

This bill did not only catch the eye of DeFi veterans, but also other exchange operators. SBF was basically attempting to use his political connections to corner the cryptocurrency markets and force other exchanges out of the US, and then eventually force them out of the market. This is when CZ began to reiterate the importance of decentralisation, taking indirect shots at SBF, adding some fuel to the fire. He made a few tweets about the importance of decentralisation, and also published a blog about it.

Further, CZ was also extremely aware of the game SBF was playing. He made some very accurate tweets, which in hindsight, now make much more sense once SBF’s empire collapsed.

“In the midst of chaos, there is also opportunity.”

-Sun Tzu, The Art of War

Only a month ago, almost everyone in the space believed that the CZ’s massive empire was on the decline. However, CZ understood the concept of going to war well, as a veteran in one of the most ruthless spaces to operate in. He simply made his thoughts public, adding some slight context to already public information, effectively handing SBF the shovel used to dig his own grave.

SBF, of course, trying to protect his image, which was important to keep his Ponzi together, fell into CZ’s trap, and made a very important mistake.

“All warfare is based on deception. Hence, when we are able to attack, we must seem unable; when using our forces, we must appear inactive; when we are near, we must make the enemy believe we are far away; when far away, we must make him believe we are near.”

-Sun Tzu, The Art of War

The above tweet was the match that lit the flame of this conflict. As soon as SBF published this tweet taking CZ’s bait, CZ retaliated immediately, stating that FTX’s and Binance’s values no longer align, and Binance would be selling their FTT stake, which was worth upwards of 500 million USD.

This was disastrous for SBF, as Alameda had used FTT as collateral to borrow user funds from FTX. If FTT had collapsed below a certain point, both companies would be effectively insolvent.

Caroline of Alameda, quickly went back on the attack, claiming publically that Alameda would buy the stake OTC from Binance to not impact the market.

This, for a short time, stabilised the price of FTT. However, smelling blood, CZ did not relent and made it clear that Binance would be selling the FTT on the open market. This was practically the beginning of the end of the Ponzi scheme as FTT began to death spiral. CZ, using only a few tweets, managed to achieve supreme victory.

“The supreme art of war is to subdue the enemy without fighting.”

-Sun Tzu, The Art of War

After losing the battle with CZ, SBF reached out with a white flag, hoping to get a buyout from Binance and to help make customers right. Binance signed a non-binding LOI (Letter of Intent) and would consider buying the failed company after it completed its due diligence.

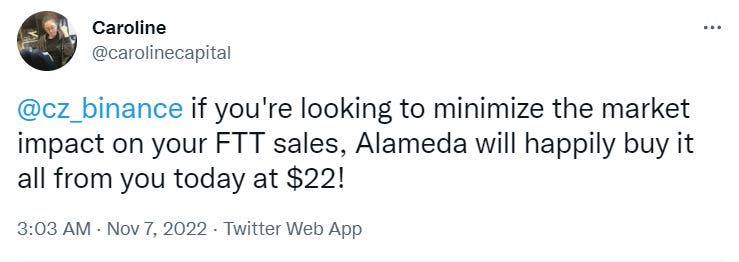

However, one look at FTX’s books was enough to scare Binance and CZ away from the deal.

And with a 10 billion USD hole, who could blame them…

Part 3: Analysis

It’s clear once examining the evidence that both Caroline and SBF were not rational actors. They were egomaniacs operating in an industry that regularly destroyed investors and projects who did not respect the unspoken but followed laws.

Don’t attack decentralisation.

Don’t create perpetual motion machines via unstable token economics.

Don’t sell out to governments and the feds.

Be cautious when going to war with veterans.

Practice strict risk management when taking large directional positions and bets.

As mentioned above, SBF clearly lacked critical thinking skills. But what could have impacted those skills, of an otherwise, obviously intelligent individual?

Sex, drugs, money, power etc. Just because you get to choose your master doesn't mean you aren't a slave.

-LeCrae

Not only were the Alameda and FTX crew sharing customer money, but they also seemed to be sharing stimulants and each other.

Chapter 1: A Harem of Nerds

According to leaked documents, the top ten employees/executives of Alameda and FTX, were all in sexual relationships, with even rumours of orgies being conducted on the Bahamas FTX estate.

When looking at some of the questionable posts made by Caroline, it’s not a far stretch.

Caroline is self-admittedly polyamorous, which are individuals who “have multiple loving, intentional, and intimate relationships at the same time”. Furthermore, she also posted on her personal Tumblr about having her own “imperial Chinese harem”.

Furthermore, leaked information later also revealed that Caroline and SBF were dating both when they were colleagues at Jane Street, and when they worked together at Alameda.

Going beyond even this, it seems like both SBF and another executive Nishad, hired their respective girlfriends/sexual partners for key roles inside the company.

On top of having poor critical thinking skills, a lack of empathy and a god complex, it seems that SBF was running a 38 billion dollar company with his small head, not his big one. This very likely contributed to the irrational decision-making, and general degeneracy at both firms, giving people power because they gave him sexual favours, and not because they were the most qualified to manage such a large and risky enterprise.

Chapter 2: Sleep is for the Weak

Not only were the top echelons of this corrupt empire sexual deviants, but they were also drug addicts. Many leaked sources claimed that taking stimulants was encouraged, and they even had an in-house doctor, which they used to get access to stimulants easily.

Some of the reviews of the drug are interesting…

Looking at some of the side effects of this drug, it explains some of SBF’s strange behaviour…

uncontrollable shaking of a part of your body.

unusual movements that are difficult to control.

hallucinations (seeing things or hearing voices that do not exist).

Looking back at this video, SBF’s insane jittering and body movements now make much more sense.

Moreover, many people often misunderstand what stimulants actually do to the brain. They don't make a person smarter, or sharper, they simply make them more alert, and also more confident. If an already erratic person takes or is given stimulants, it just makes them more erratic, which leads to worse decision-making. Clearly, SBF and co’s stimulant abuse played a role in their disastrous decision-making, which ended in their downfall.

Chapter 3: Downfall

So, what actually caused the downfall of FTX and Alameda? One theory suggests it could be because of FTX’s poor liquidation engine, and Alameda finding itself taking on toxic positions after the Luna death spiral.

This Twitter thread does a great job explaining how Alameda could have potentially been on the other side of many bad positions due to the extremely toxic order flow caused by the Luna crash. Basically, this theory states that Alameda may have taken over liquidations on FTX and managed the risk using discretionary internal models. This effectively allowed third-party market makers to quote a lot tighter on FTX than on any other exchange, making FTX much more competitive than the competition.

However, Alameda was flooded with liquidations this year due to the collapse of Luna, Celcius and other severely directional moves. This resulted in the internal risk model breaking, potentially causing a massive, billion-dollar hole. The theory also continues to state that in order to maintain market supremacy, FTX bailed out Alameda, with Alameda providing FTX illiquid FTT tokens as collateral.

An old tweet made by SBF lends credence to this theory…

The more logical answer is that Alameda simply made a series of bad bets, which also happened to be illiquid. This included investing in assets such as ETHE, stETH and GBTC, all of which trade at discounts, and are difficult to liquidate.

Combined with the faltering price of FTT which propped up the books, eventually, Alameda was margin called, being bailed out by FTX using user funds. However, once a bank run was initiated by users on FTX, forcing FTX to pause withdrawals meaning assets weren’t backed 1:1, the entire scheme collapsed.

Part 4: The Future

Many participants in the cryptocurrency space see the failure of FTX as a massive black mark on the industry. We, the team, disagree with that position. The whole point of the crypto industry was to build an alternative financial market, free from the greedy hands of regulators and drugged-up simp CEOs. The fall of FTX has cemented the use case of decentralised finance, which the market is already reflecting, as decentralised derivatives exchanges like dYdX and GMX saw massive increases in user adoption and volume, even as the market collapsed.

The promise of cryptocurrency remains strong, and it is now more clear than ever that centralised competitors need to also support decentralisation, otherwise the market will chew them up and spit them out. Both CeFi and DeFi can live in harmony, as long as the former does not try to attack or corrupt the latter. Many have tried, including SBF, and were destroyed.

Although this may cause some short-term pain, in the long term, the death of such a corrupt player will be good for the industry as a whole, and more weak players will emerge and be washed out by the market, creating a more anti-fragile industry.

As for SBF, there is a high likelihood he and many of his associates will serve time in prison, and will never be allowed to work in or operate a company in the financial sector ever again. Showing just exactly how sinister he is, he has figured out a way to delete his past tweets without having them archived, looking to scrub his tracks clean to hopefully help him in his upcoming legal battles. However, the internet never forgets.

The cryptic one-letter tweets are not some kind of dead man’s switch or message, it’s a desperate attempt by the morally corrupt CEO to wipe his tracks clean.

Many users were wiped out in this saga, however, do not despair. Although this will set back the industry, it will also give everyone the motivation to learn how to use DeFi, which will be the spark that sets off the next run, untainted by corrupt centralised entities.

We, the team, are still as bullish on crypto today, after these events, as we were when we first started researching this space. FTX and Alameda was a parasite, which has now been purged for the better of the whole ecosystem.

Eventually, this saga will be relegated to the history book as the builders keep building, and the market moves on.

“It is said that what is called "the spirit of an age" is something to which one cannot return. That this spirit gradually dissipates is due to the world's coming to an end. For this reason, although one would like to change today's world back to the spirit of one hundred years or more ago, it cannot be done.

-Hagakure

🗡️Thank you for reading our work and supporting our message🗡️