The collapse of SVB and how the FED is likely to React

With the collapse of SVB, Central Banks are now reassessing rate hikes. We look at history to guestimate the future

By now, you’re pretty clued in. SVB, a tech-focused Bank operating out of… you guessed it, Silicon Valley collapsed recently. The idea of individual gains and socialized losses read true AGAIN when HSBC, a global banking giant, swooped in for the rescue and bought the UK subsidiary for a cup of coffee for £1 ($1.21). That’s not a typo. They probably got the bargain as they didn’t purchase the assets or liabilities of the Parent company in the United States, just the coffee mugs and stationery from the UK outfit.

But you’ve heard this, it’s an old tale as old as time. We’ve ostensibly created a bailout culture where bad banks get bought out, and big banks get bigger. This isn’t analysis.

SVB and the FED

In our previous few articles regarding monetary policy, we looked closely at comments coming out of the FOMC. With the collapse of SVB and teetering of Credit Suisse, one of the world’s largest Investment banks, it is now clear to everyone that maybe Inflation may win and the continuous tightening of policy will be disastrous.

WE CALLED THIS. How did we call this?

We looked at history, looking at both doomers in the media and fed Chairmans alike. Long story short, the world is only ending when the Central Bank says it is.

Inconsistent Market Chat

Remember a few years ago, when Governor Powell and local governor Lowe said in unison that rate hikes weren’t on the cards until 2024 or 2025? Yeah, how’d that work out for you? With the Inflation/Covid/Recession crisis, Central banks needed to pivot sharply, and the rest is history. Launching rates in the subsequent years. The first lesson we wanted to impart was, NOTHING IS CERTAIN.

During the rate hikes, they always said rates will continue to rise until 2024-25, but we knew better. Like in 2021, Powell needed to pivot on the spot so we knew that regardless of what is said, Central banks MUST be flexible. And now we have the result. Goldman Sachs, now predicting an inevitable rate pause for at least a few months, is something we told you for free a few months ago.

SVB is one in a long list of indicators that rates were coming to a halt soon. The inevitable rollover of Hundreds of billions worth of mortgages to unsustainable variable interest rates in Australia is something we mentioned a few weeks ago as a major catalyst for rate pauses/cuts.

Too Much pain to handle

Our previous items also outlined that it was always a race to battle Inflation whilst also ensuring the global economy wasn’t completely snuffed out. We overestimated the solvency of most institutions and assumed we could keep tightening. Wrong. With SVB collapsing and UBS needing to throw Credit Suisse a lifeline, the battle may be coming to a close sooner than we think. If this potential rate pause is any indication, it may outline that a high(ish) inflation rate may be a new reality that cannot be tackled aggressively and curbed in 2 years. It may need a decade-long approach of micro cycles where we aren’t waiting for both rate hikes and cuts for ten years. We may see more frequent yearly cycles of interest rate movements to ensure the FED can keep up with the market experiencing monthly volatility.

It might be time to buy the dip as the Rate Hike snowballed through the world economy. However, in the end, it finally hit its target. There is a method to the madness, and inflation, as sticky as it is, is being pummelled down to 6%.

Looking at History to see the Future

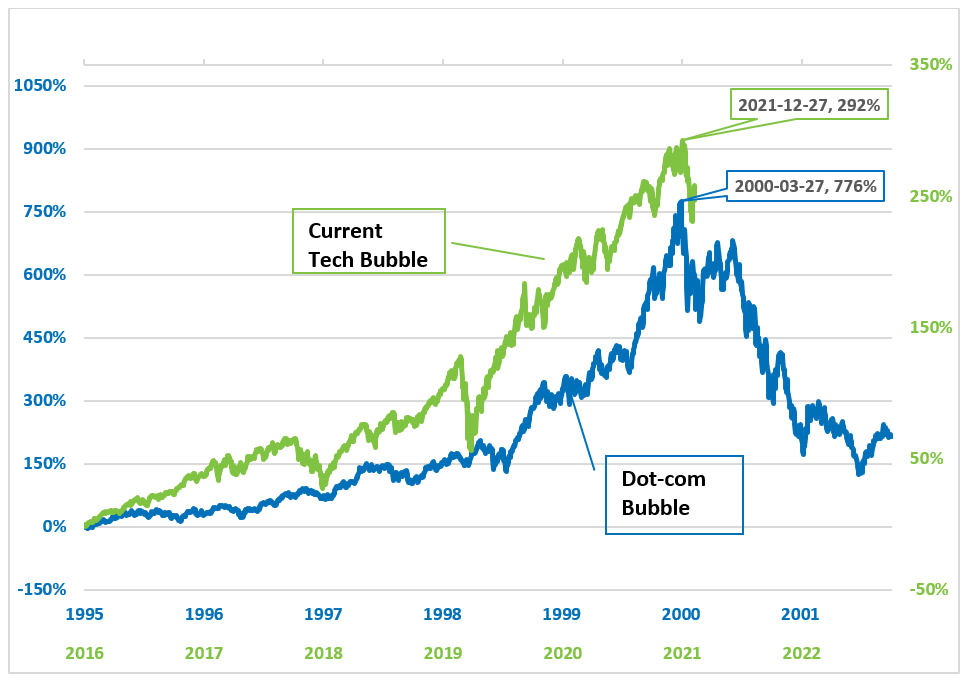

One could even argue that this was to be expected. The rate hikes were bound to inflict pain, sound financials meant you could weather it, and being over-leveraged and highly exposed to the tech sector does not make for sound business practice. The Dot Com bubble of the 2000s provides guidance here. It is common knowledge that Tech is always the first to go.

The collapse of technology companies and large redundancies in FAANG companies paint a similar picture to 2001. Technology stocks rose exponentially in the two years prior to the peaks of both the dot-com bubble (Mar. 2000) and the current bubble (Dec. 2021), resulting in the Tech sector representing about a third of the US market at the height of each bubble. A culture of free money, VCs, and tech bros makes for a potent mix that we saw in 2001 and again in 2022.

NOTE: Diversity quotas are not why SVB failed. Poor risk management is. Don’t be a moron on Twitter.

What goes up must come down for crypto, real estate, and equities. Tech flourishes in bull markets and compounds returns more than three other sectors put together, HOWEVER, they are also the most exposed. SVB is an example of this over-exposure to one sector.

What’s the Point of this Article?

This is a reactionary piece. We see that the rate pause was on the cards and informed you of such. The pain was too great, and a bank blew up. Although scary, please remember that market regulators and the FED will need to maneuver quickly. We can’t see a clear future here. However, we do see a rate pause in the next few months and a sharp rise in inflation as the world thinks we’ve arrived at the right spot for inflation. Once the FED affords enough critical time for the banks to shore up their balance sheets, they will likely resume rate hikes until late 2023.

🗡️Thank you for reading our work and supporting our message🗡️

Great read as always.