The Bitcoin ETF and what comes after

For the second half of 2023, the Bitcoin ETF narrative was in the spotlight but crypto has existed before it will do so after. Where will the money flow to next ?

The Bitcoin ETF is almost upon us. This article will be a brief look at the BTC ETF news and try to look forward and see what may be the narratives to watch this bull run.

When we mean narratives, these are general ideas, sectors, and ecosystems that may catch bids at some point in this cycle. In no particular order as sectors can rally in unison too. Old assets have life breathed into them and new themes are catching fire with the retail market.

Let’s take a look

Bitcoin ETF

Consolidation and the ability to hold your guts in place is very bullish. Every action has a consequence and markets are no different. After the initial rally, BTC needed to consolidate for around a month or so before it ripped again. Since the pump in early December to 40k it has been ranging very nicely however, we still need to address what happened a few days ago with that flash dump.

We understand that our informational edge is limited so we can do 2 things. Either speculate that it was a Leveraged Shakeout(probably) to suck up liquidity from retail holders or we can accept a simpler truth. A 5% drawdown on BTC is to be expected in Bull markets. Even in Bull markets prices can be extremely choppy.

As long as you stay true to what we say and DCA into BTC for the long term, you will be all the richer for it. always be buying small parcels. ETFs are a vehicle for liquidity and every asset manager will now be competing to provide the best returns for their BTC portfolio for their clients.

Disclaimer: We are not shills. Always assume we have positions. We will provide the general direction to look at, not specific tokens. The rest is up to you to narrow down.

Now what comes after

SOLANA

It beggars belief that Solana was a dead ecosystem a few weeks ago and something of the SBF ponzi 2021 era. Look at us now.

Solana was previously relegated to the shi!ty basket of Dino Coins you could find Litecoin in. However, it has suddenly found life and 5x from its bottom to $120. Why? If we knew the hard truth we’d be retired however we learn an important lesson from this:

Nothing is truly dead in crypto as long as there is money behind it

Do not try to outsmart the market and come up with a thesis that Solana is bad and counter-trade it.

Take the trades as you find them.

Solana is a very retail-friendly ecosystem. WHY is Solana pumping and not ETH? isn’t ETH number 2 to BTC. Who cares about ETH forks, ETH protocols, and ERC 20 when the pumps are happening in Solana

And this isn’t to say Solana is the next best thing. The point is to find narratives to play. What we see is that Solana and by extension, its ecosystem plays are incredibly retail-friendly. Many onchain tokens as well as NFTs have found new homes to 2-5x on the SOL network. Who are you to say it’s a dead ecosystem? We trade the market we find ourselves in, not outsmart it. Your thesis on “Crypto Insurance tokens” is something no one cares about. This is why the punters in crypto end up richer than data scientists in crypto. Get out of your way and take the easy route if it presents itself.

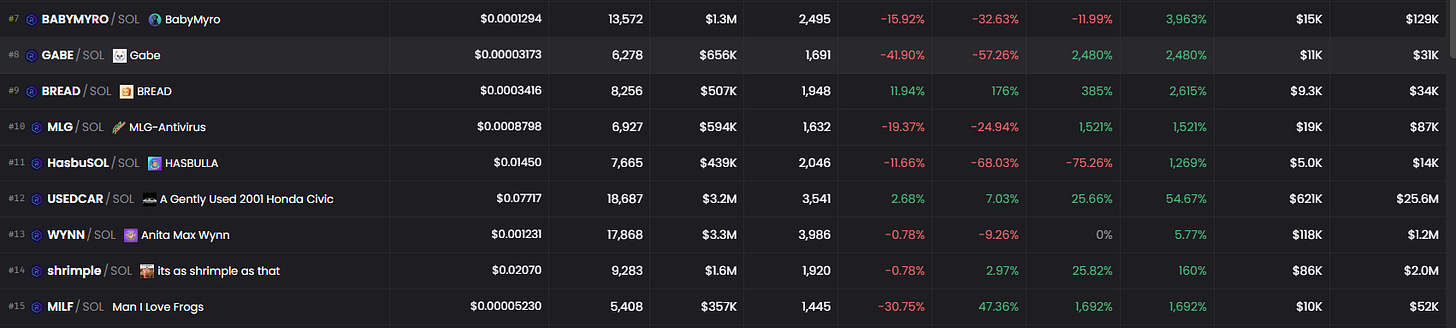

You need only look at the names above and laugh. 99% of crypto is pointless and you will make money if you understand this and trade accordingly.

An ecosystem to watch.

Artificial Intelligence

AI is the newest hot sector in Crypto. The basic lay of the land can be understood by looking at the stock market. When OpenAI opened the floodgates with Chat GPT, the stock market ponzinomics went into overdrive. Sure there are some legitimate players in AI like NVIDIA and Microsoft however for every OpenAI there was some company raising $1B in capital to fund essentially a language model plugin. Nice one. Investors are as a whole f#!king morons. We can use this.

Crypto is a thematic follower of the stock market and YOU WILL see the same cap raises, the same pumps on absolute garbage happen with “AI coins”. Do they work, who knows, Do I care, absolutely not.

AI is something that will drive us into new opportunities however for the time being we must establish some basic rules as to how we can sort out the good AI plays from the bad ones. Here are some filters to keep in your head:

AI is incredibly resource-heavy.

There is a critical shortage of Data storage to keep up with AI growth

You will make more money trading the coins that provide the infrastructure and plumbing for AI than actual AI coins.

Decentralized computing, Data storage, and anything that supports AI's building blocks will be golden.

Convert this thinking. NVIDIA will provide the chips for the AI boom. Decentralized computing and modular blockchains will provide the infrastructure for AI in Crypto.

AI itself means nothing. You need to look at what tools it will need to grow. Sell the picks and shovels, don’t mine for gold.

Onto more niche plays

Layer 2

If you think about Cryptocurrency, how would you visualize it? As a city, as a castle, as a McDonalds drive through. For all its talk about Decentralisation, money, and resources tend to flow upwards and consolidate into a handful of players.

Think of crypto as a field of grass with multiple species of grass on it. The crops grow differently and vary in quality but none are denied space. Garbage can be planted. Smart money just knows which crops are better to invest in.

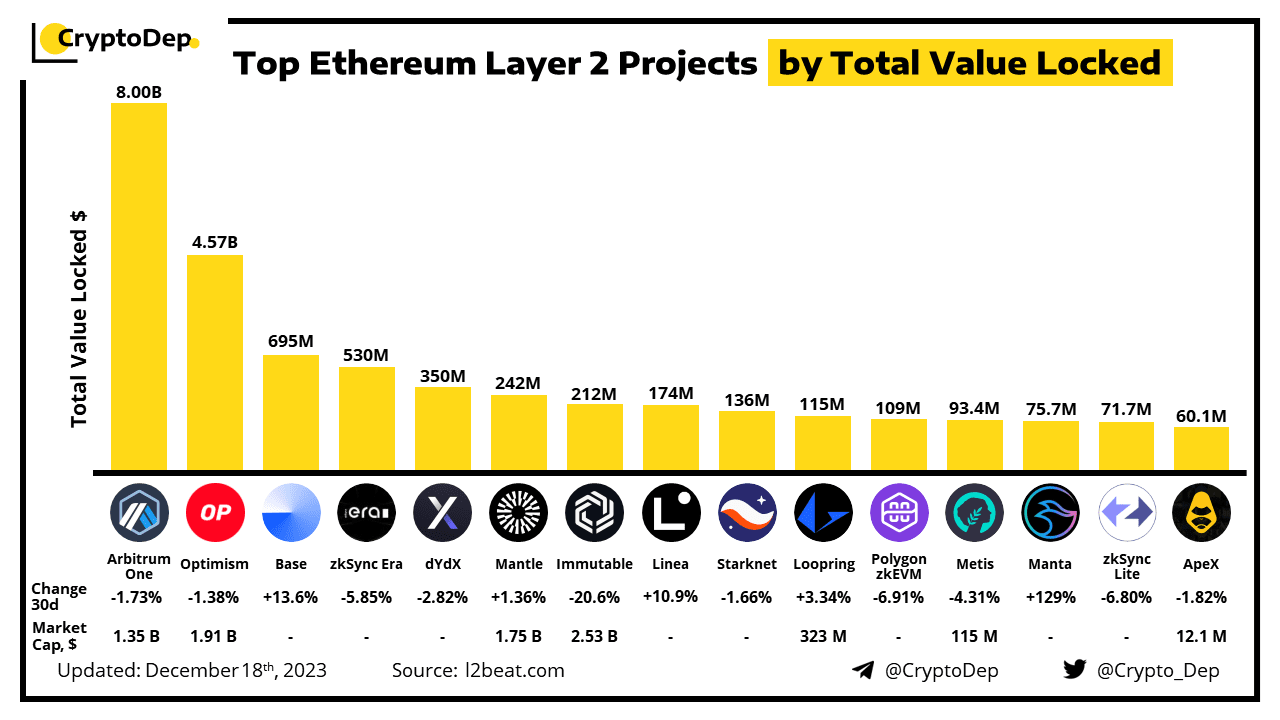

Layer 2 is this cycle’s version of ecosystem wars. This isn't to say that Layer 1s cannot catch bids. (Look at Solana and AVAX, don’t try to be too smart). However, the clear advantage at an institutional level goes to ETH.

Institutional advantage as in, an Investment bank or Clearing House will want to work and clear money through ETH, not punt on sh@tcoins son SOL.

Some examples below:

If we come from a narrative perspective, people like a good tribal war. SOL v AVAX, Australia v England. Narratives and stories sell. One such story is that if ETH won the Layer 1 war, then this Layer 2 war will be about who can build and innovate the most on the ETH network. We find the best tribes and set them against each other. Both get stronger and you make money playing both. Get on it ASAP.

Notable mentions (Google them, this article is already too long)

DeSci

Eth ETF

BRC 20s

DePin

Conclusion

Crypto when in a hyperactive bull market must be kept busy as it is borderline nerotic. Once the BTC ETF narrative has built up and played out. HUNGRY retail and Insto money will immediately look for the next high. We have listed some very real candidates who will be serious topics of discussion over the next few years. You need to build watchlists for each of these sectors and find which ones have pumped because that pump may be a sign of things to come. separate the wheat from the chaff and find the 3-4 winners that can get you retired this cycle. Good luck.

Subscribe so you can survive the bull market