Lessons For This Next Bull Market

Learn how to actually not fumble the bag this time

Some of our team members are veterans of the crypto markets, and others are still finding their footing. Here is a short collection of lessons that may help you avoid some potholes along the way.

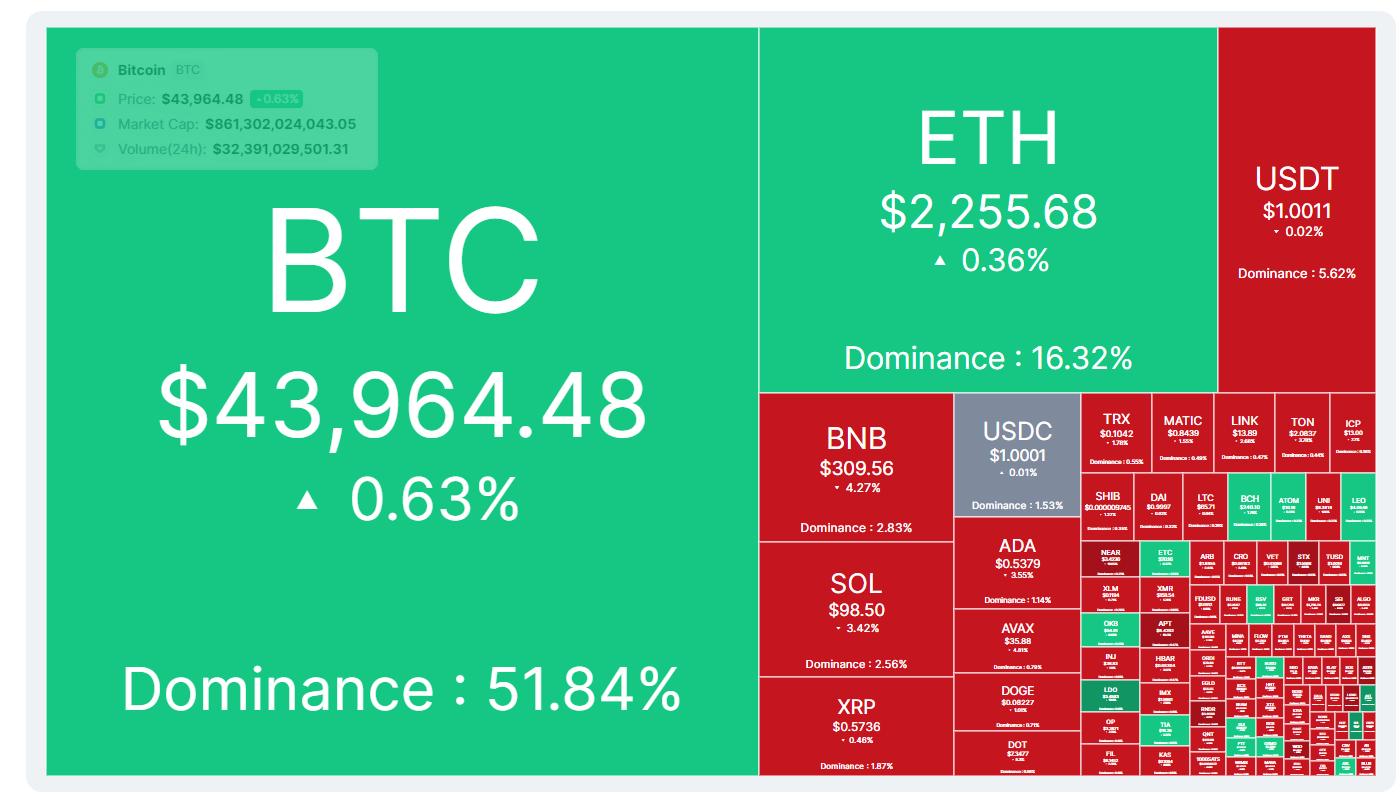

Narrow diversification

Crypto is not the stock market. I say again. Crypto is not like the stock or any other market. It is correlated to stocks but has some unique characteristics that charlatans on Crypto will have you ignore. Cryptocurrency is only $1T in Market Cap as of very recently (it will be much higher now). Bitcoin translates to roughly half of that market cap sitting at $500B(not recent). I will throw in a graph, but the long and short of it is that if Bitcoin does well, even garbage will catch a bid. If Bitcoin does poorly, even your 200IQ Crypto Insurance Protocol is not safe from a 15% dump.

Hence, a diversified portfolio is useless in crypto. You can’t buy ADA to hedge BTC downside. All you can do is ensure that your leverage and spot positions are properly collateralized so that even in a 20% downturn in Alts, an exchange won’t liquidate your long-term holds. It is risk management and low leverage that will save you from a 20% dump in BTC, not a diversified portfolio, which is just a higher beta version of BTC.

Don’t knock any Sector.

SOLANA is suddenly alive again. Only a few weeks ago, ETH and BTC were the majors in focus and now SOL is back on the menu. This is a lesson in humility for all of us.

Solana has suddenly found life and 5x from its bottom to $120. Why? If we knew the hard truth, we’d be retired; however, we learned an important lesson from this: Solana is a very retail-friendly ecosystem. WHY is Solana pumping and not ETH? isn’t ETH number 2 to BTC. Who cares about ETH forks, ETH protocols, and ERC 20 tokens when the pumps are happening in Solana? The lesson here is that we need to trade the market we find.

Do not carry our biases and losses from previous cycles into this one.

If you want to stretch this mental exercise to its extreme. You may think now that AVAX and NFTs won’t ever be a thing again. See, that is your bias speaking. I hate NFTs but will humble myself to know that they may very well catch bids so I MUST be aware of developments in them.

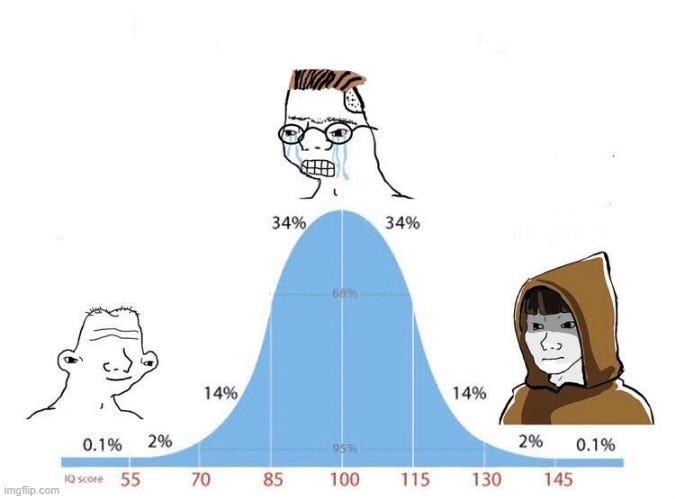

Don't Mid-curve trade

This is a distribution curve with most people falling in the middle. In other words, if you ever find yourself looking at both your borderline stupid friend and the abnormally intelligent friend and wonder why both have lots of money. Chances are, my friend, you fall squarely down the broke as F@#K middle.

The moron in the circle bought Pepe and Doge because memes are funny, and the hyperintelligent homie understands the potential of Doge as a higher Beta version of BTC and an avenue as a payments exchange. You fall squarely in the middle. You think doge is stupid, and everyone who buys it is an idiot, too. Yet you have many fewer dollars than either.

YOU lack the intelligence to research crypto but don’t want to treat it like the game and Ponzi it is like your gambler mates. As such, you lack the conviction either has, and it is a habit you must break. Either become a maestro in crypto or understand it as a Ponzi and punt on it as such. Don’t cry and cope. Get involved.

Dont find a sector so niche that it isn’t pumpable

I’m going to let you in on a secret. Fund managers all suffer from something called career risk. They are judged on profits, not imagination. As such there are maybe a handful of actual contrarian investors in crypto who are short-biased and look for hidden value. This is how NFTs can catch bids and Crypto Insurance protocols don’t.

They need the path of least resistance, so why spend all those resources on marketing and buying into severely niche sectors when there is a perfectly reasonable amount of sectors just itching for pumps and having mass marketing appeal? AI can be marketed, and so can NFTs. Agricultural cryptos can’t even though they may have a use case.

Don’t be the guy in the party hat at a crypto conference about meme coins who talks about Integrating the blockchain into the FX markets.

Tradingview Alerts

You cannot track everything in a 24/7 market. Set up price alerts that ping you key updates in price so you don’t rip your hair out when you miss a pump. Short and simple tip.

Teamwork and understanding your limitations

This is perhaps the most important thing you will learn in this cycle. Crypto funds are stacked with people whose entire jobs depend on dollars, to sit together till they figure it out. You have chosen Investing. You have no inside info, no Algo, no edge, no system in place. But want to do it yourself. You need a team, people who you can reflect ideas and theses off of… you need Family.

There is no degree in Crypto. You learn through the environment around you. Most of the people in crypto you meet will know nothing. However, the few gems you will find will be invaluable. For example. I understand technical analysis and volume on majors and know entry and exit signals; however, I am out of my depth when it comes to onchain DEX trading. This is a limitation, but that’s fine. It is okay to lean on others and have them lean on you. All the data and systems lack one key thing only humans can provide: context and intuition.

For, e.g., themes in crypto just seem to pop up out of nowhere. How will you understand the market pulse if you have no other market participants to reflect with? Go online, get in discords, and discuss ideas like AI, Modular blockchains, and decentralized computing. Surround yourself with competence and provide it yourself. This is the real ticket. Building a network to aggregate intuition and intelligence.

Conclusion

Small rules like the aforementioned will not in themselves make you rich. However, it is small habits and quality-of-life fixes that will make your life easier. The common line here is convenience. You don’t need to make this journey yourself. Everything from your watchlist to your PC, social network, and token research needs to be streamlined for convenience. Then, only then show it to your network for them to either approve, reject, or critique it. All of which will ultimately make you a more polished investor.

Now get out there and figure it out :)

Let’s make some money :)

Thank you for reading our work and supporting our message🗡️

hi bros