I Spy CPI - Was the Data Dump on Friday enough to Rally the Markets?

An analysis of the AUD/USD pair with commentary on what the Federal Reserve may look to do with the fresh CPI print

The AUD/USD saw a monster rally off the bumper-to-bumper slot of Tier 1 news coming out of the US on Friday night. The data splurge certainly spurred markets on Friday and through the weekend while most of us were out doing anything other than watching US Employment Data releases.

Here’s a summary of what has happened and what may in the coming days as Australia will release its Monthly CPI and the US will follow on Friday.

To recap here’s what happens to the Aussie dollar when the US comes short of market expectations with respect to labour data.

AUD/USD

On Friday we saw a brief dip but the macro-outlook of the pair saw, the subsequent rally saw the pair rise 162 pips breaking the 69c barrier this morning which has held the pair at bay since August 22.

The US data was as follows:

US Average Hourly Earnings m/m came in at 0.3%, fell short of expectations of 0.4%

Non-Farm Employment Change was the standout beating expectations by 33k, printing 233K new jobs

The unemployment rate came in lower than last month’s 3.6% at 3.5% but fell short of the 3.7% expectation.

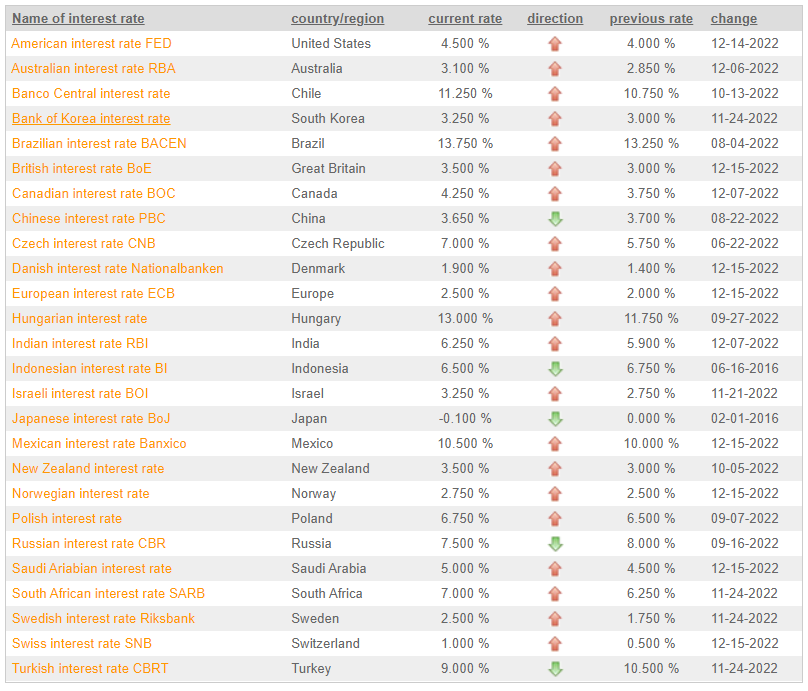

You’d think that these numbers were good enough to spur USD strength. However, we need to look at the markets from the point of view of the Federal Reserve. The central bank is looking for the unemployment rate to climb as and put downward pressure on wages as their primary goal is the slow down the economy and curb inflation. The Fed will be happy to see that the inflation component of jobs data was lower than expected and much lower with the November revisions.

This is where we look ahead. The local CPI figures coming out on Wednesday coupled with the easing of Aus-China relations provide a unique situation for the pair to surge ahead if the coal tariffs and opening of the Chinese border hold strong in the long term.

This will be followed on Friday with the US CPI figures. If the numbers come out hot this may still be a signal to the Fed that rates need to be hiked a 50 Bps increment to further curb inflation. If inflation is tamed, then we may be looking at 25 Bps hikes in the future.

The RBA which meets on the first Tuesday of every month will also no doubt be looking at local and international Inflation data to assist them in their monetary policy direction going into 2023.

Whichever way you cut it sure is an interesting time to be a market participant.

🗡️Thank you for reading our work and supporting our message🗡️