His Name was Kyle Samani - Why Crypto VCs are Clueless

An analysis of what dumb money looks like and why investors should not LP with Cryptocurrency VCs

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

-Sun Tzu, The Art of War

This quote does not only apply to the art of war, but to investment as well. Cryptocurrency is rife with bias, whether it be the Bitcoin maximalists, shitcoin maximalists, or investors shilling cults of personality. The last part of the quote resonates the most, as many investors in this space do not know themselves (ie have a strong conviction on certain technologies) nor the counterparties they invest in, resulting in liquidity providers and the market being crushed by either their stupidity or willful ignorance.

This article isn’t meant to be a hit piece against Kyle and Multicoin capital particularly, but the intent is to serve as an example of why cryptocurrency venture capitalists (VCs) are truly bottom of the barrel when it comes to due diligence. We also want to preface by saying not all crypto VCs are bad, but most are.

Part 1: FTX Saga

Before reading this section, we recommend reading our article “The Revenge of the Nerds: How Ivy League Rich Kids Fumbled a 10 Billion Dollar Bag” to get a better idea of how bad the FTX situation was.

FTX was always a fraud, from the very beginning. And yet, somehow, not a single one of the VCs who invested in the exchange was able to figure this out. Let’s look at the list of VCs who decided to give SBF more money to fuel the Ponzi.

Temasek

Paradigm

Sequoia

Ontario Teachers Pension Plan (OTPP)

NEA

IVP

Iconiq Capital

Third Point Ventures

Tiger Global

Altimeter Capital Management

Lux Capital

Mayfield

Insight Partners

Sequoia Capital, SoftBank

Lightspeed Venture Partners

Ribbit Capital

BlackRock

And more…

It’s also important to note that many other protocols, hedge funds and private investors/users lost money in FTX. The most famous being Kevin O’Leary, a paid shill for FTX, losing apparently 15 million dollars in the exchange when they finally went bust.

Combined, these investors lost north of a billion dollars. The interesting takeaway from this is how not a single one of these investors where able to verify the exchange’s books. The most obvious response by these funds is that FTX and SBF did a good job at obfuscating the fraud and hence everything looked “normal” during the due diligence process.

This is a myth. There were many red flags that pointed to obvious issues which they could have dug into more to help expose the fraud. Instead, they wanted in on an already over-crowded trade, so they threw money at SBF, and then lead the sheep to the slaughter. Let’s look at some of the practices exposed by the new CEO John J. Ray III and other investors/traders that interacted with SBF and FTX.

Part 1.1: Receipts

FTX using QuickBooks for Internal Accounting Reconciliation

If it wasn’t already obvious, using QuickBooks to handle internal auditing and accounting for one of the largest cryptocurrency exchanges in the world is incredibly negligent. Let’s go through some of the reasons why:

The complexity of cryptocurrency transactions: Cryptocurrency transactions are complex and may not fit easily into the traditional accounting categories used by QuickBooks. For example, it may be difficult to classify a cryptocurrency transaction as a purchase, sale, or transfer. Additionally, in the case of forks, airdrops, staking, mining and other crypto-specific events, QuickBooks might not have the flexibility to record these events in the correct accounting method.

Lack of tax compliance features: The IRS has specific guidelines for how to report cryptocurrency transactions on taxes, and QuickBooks may not have the necessary functionality to ensure compliance with these rules. For example, it may not be able to correctly calculate gains and losses from trading and correctly report them on tax forms like 8949 or on other forms as per jurisdiction, QuickBooks may also lack features for reporting income from staking or mining.

Handling multiple currencies: Cryptocurrency exchanges often involve multiple currencies, and QuickBooks may not have the capability to handle foreign currency transactions. This can lead to errors and inaccuracies in accounting and tax reporting, as well as difficulties reconciling accounts.

Inadequate reporting and tracking: The dynamic and fast-paced nature of cryptocurrency trading requires proper reporting, tracking and analytics. QuickBooks may not provide the level of detail and customizability needed to properly report on and analyze trades, and track different crypto-assets held and other crypto-related activities.

Lack of real-time data: The cryptocurrency market is 24/7, but QuickBooks is not designed to handle real-time data input, which can lead to inaccuracies and errors in accounting and tax reporting, making it difficult to track and analyze trades in real time.

Furthermore, the new CEO of FTX noted that they made internal invoices via Slack for expenses and used emojis to identify if those expenses were filled. A story by impacted investor and VC Kevin Zhou on the Unchained podcast really hammers home the unrivalled incompetence of FTX.

Kevin Zhou of Galois Capital (the famous Luna shorter) highlights how sometimes Alameda would not reconcile trades with Galois even days after execution, as well as how the wire instructions for sending money to FTX OTC were in fact for Alameda. It’s surprising how not a single VC was able to pick up on this and ask questions as to why users were being asked to wire funds to the hedge fund owned by FTX when both entities were supposed to be separate.

We wouldn’t judge you for assuming malice here, but we believe Hanlon's razor is apt here:

"Never attribute to malice that which is adequately explained by stupidity."

Part 2: Performance and Due Diligence

In a bull market, being a cryptocurrency VC is a dream. This is because most large projects will throw themselves at VCs to gain funding to build a community and occasionally, an actual protocol. Hence, many of these VCs tend to amass massive amounts of unrealised PnL (profit and loss) and use this as the basis to gain more leverage, and effectively “long there longs”. If you would like to understand the key differences between realised and unrealised PnL and why it is important, it is recommended you read the Twitter thread below.

Whenever a large fund makes an investment in a currency, most likely a large percentage of those tokens are vested. This means they are forced to bag hold the token for long periods of time until it unlocks and they can sell. However, even still, they tend to make significant returns, due to the fact they were first. Greed then set in. Circling back to FTX, there is literally a no better example of this. Many people forget that FTX embezzled client funds in Bitcoin, Ethereum and Fiat to prop up their low float high FDV (fully diluted value) shitcoins.

The dump of Solana’s TVL is hard proof that the entire ecosystem and subsequent Solana summer bull run was almost all FTX pumping significant liquidity into the system using customer funds.

Furthermore, many hedge funds have filed for bankruptcy as the house of cards came tumbling down. Most notably 3AC, who was lauded as geniuses, played a part in taking down one of the largest lenders, Genesis. Other funds like Mgnr deleted all tweets and went quiet, claiming the market has become an “echo chamber”.

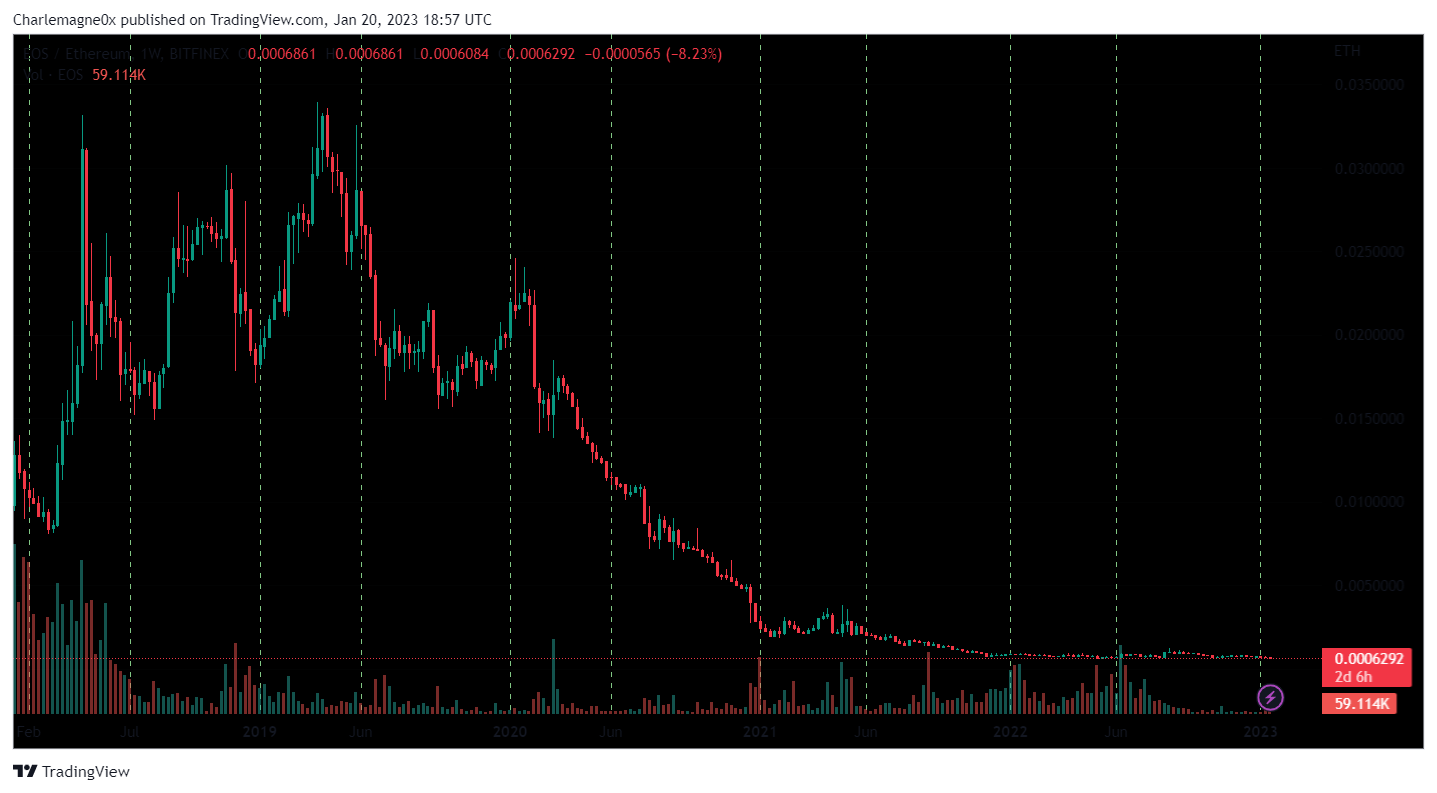

Kyle Samani’s Multicoin Capital also ate massive losses on their heavy Solana bags. Not only did they serve as exit liquidity for EOS in the 2017-2019 cycle, but also served as exit liquidity for Alameda (who also lost everything) and the Solana ecosystem grifters.

The fund, as of December of 2022, was down more than 55%, losing a large chunk of capital in FTX and FTX equity, and also via Solana. And yet, with such horrendous takes, they were still able to raise money.

Let’s look at some of Kyle’s best takes:

Bad take #1: Security isn’t the most important factor for Blockchain networks

Security is of paramount importance in a cryptocurrency network as it ensures the integrity and reliability of the network. A security breach in a cryptocurrency network can have a domino effect on the entire system, potentially leading to the theft of funds, disruption of transactions, and a loss of trust in the network, which could ultimately drive away users.

Moreover, the decentralized nature of most cryptocurrency networks means that there is no central authority to protect users' assets. In a traditional financial system, there are many layers of security such as bank accounts, credit cards, and government regulations that protect users' assets. But, in a cryptocurrency network, the users are responsible for the security of their own assets, which makes it even more important to ensure the security of the network. A single catastrophic attack like a 51% attack could destroy the integrity of the network wiping out user funds and confidence.

When a person understands in detail how cryptocurrency systems work, it becomes clear why Kyle’s takes are brainless. It’s hard to feel bad for LPs when they willingly invest in someone with such a basic understanding of how blockchain networks fundamentally work.

Although many of his tweets are now deleted, Kyle and Multicoin capital were both very bullish on EOS

Bad take #2: EOS > ETH

We don’t really need to explain this one, let’s look at some charts…

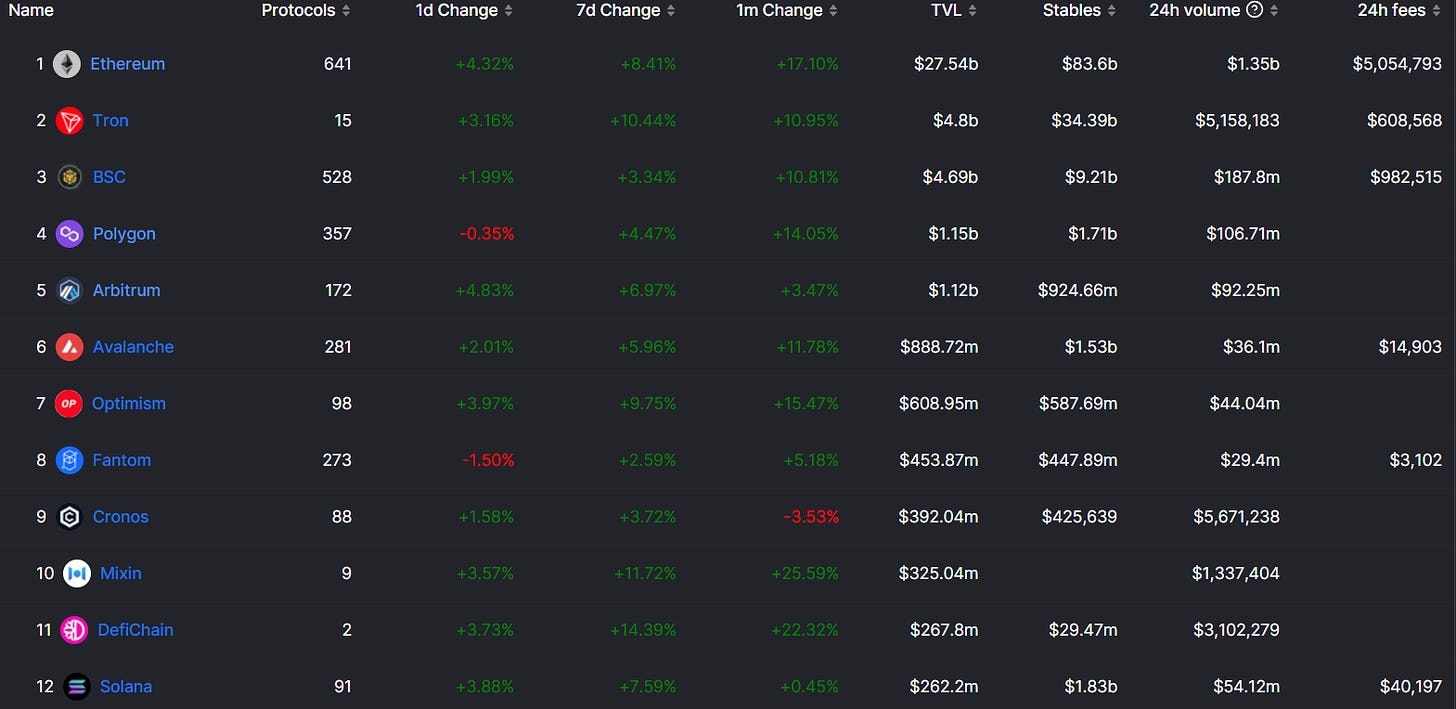

EOS/USDT

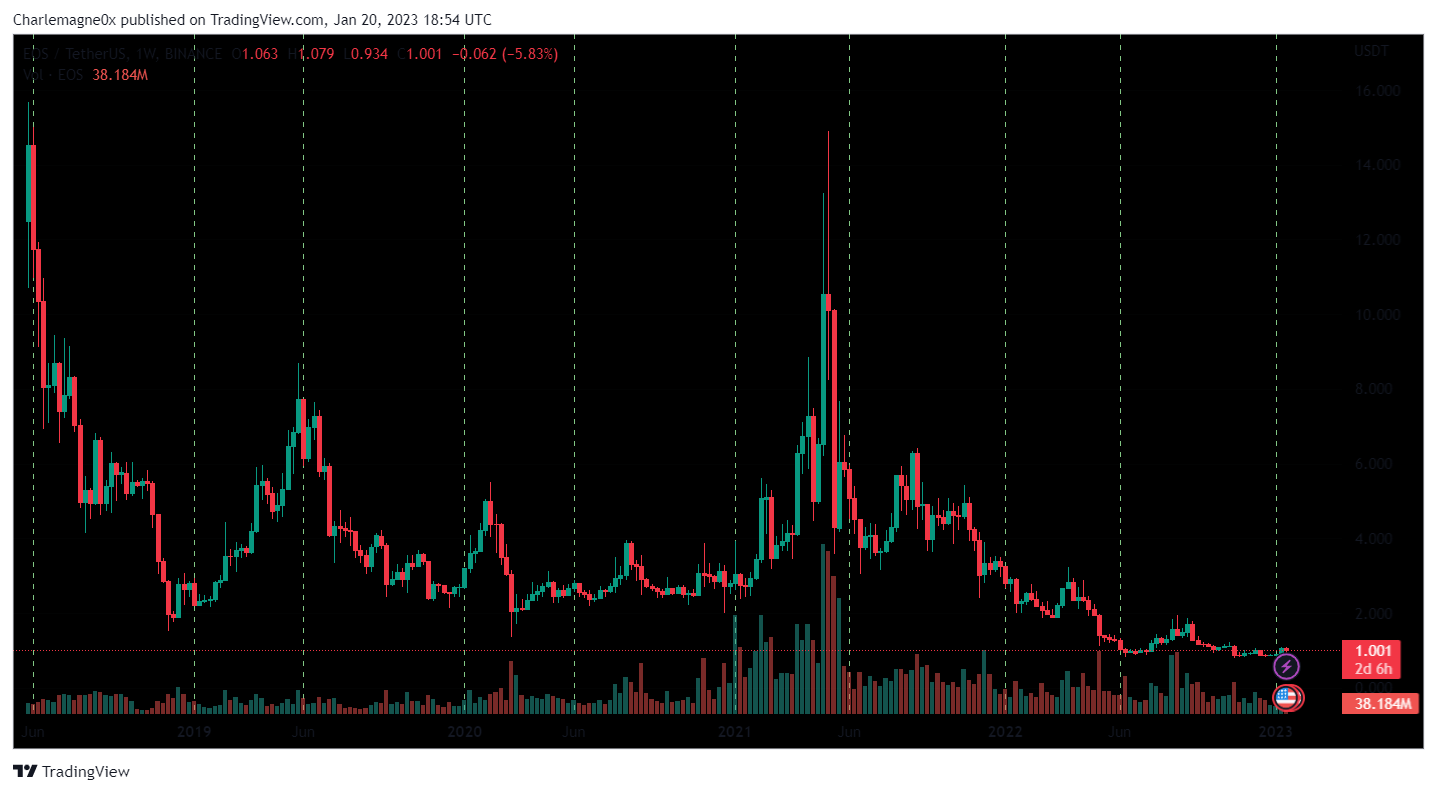

ETH/USDT

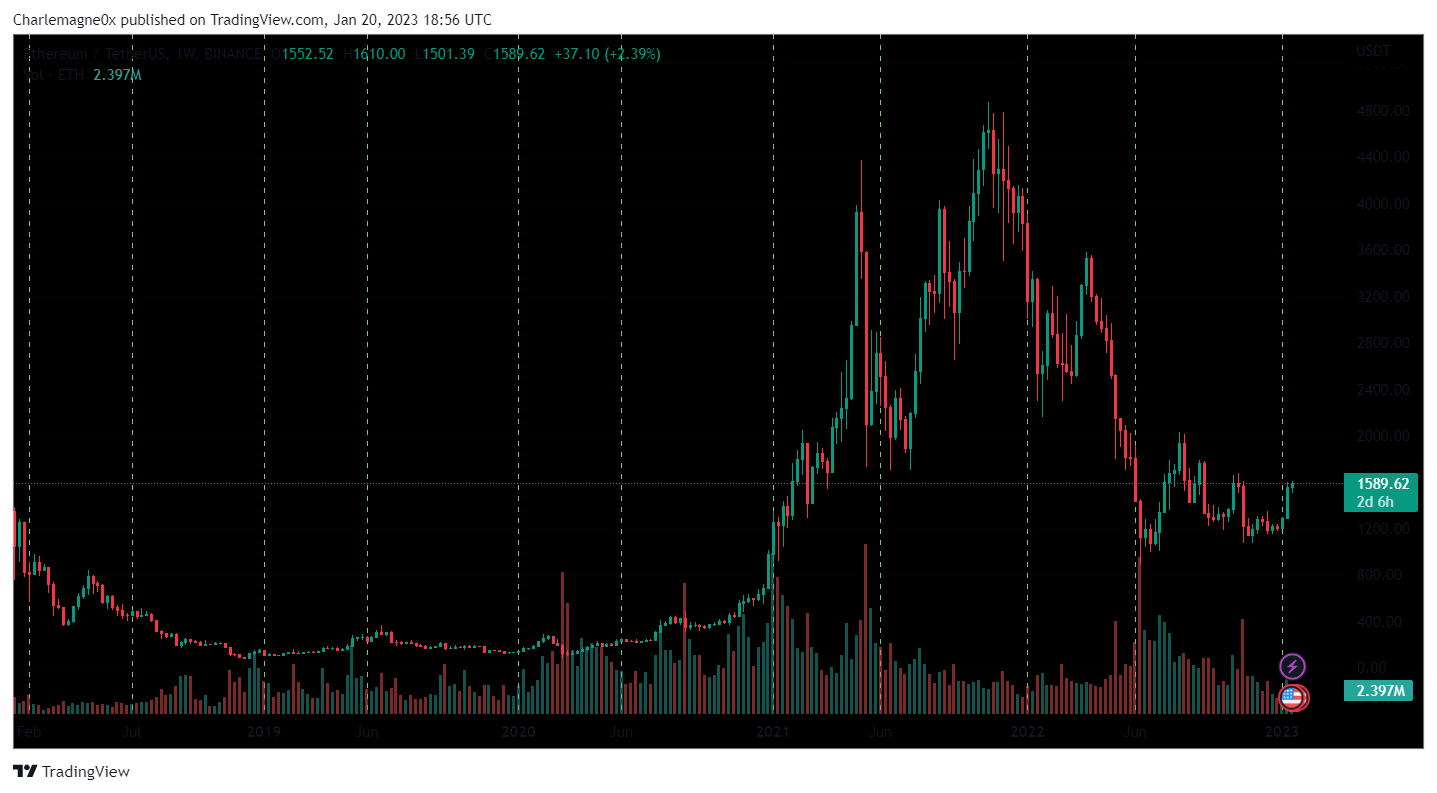

ETH/EOS

Clearly, Kyle, who has been a VC in the space for a very long time, has no idea what the f*ck he’s on about.

Bad take #3: SOL > ETH & BTC

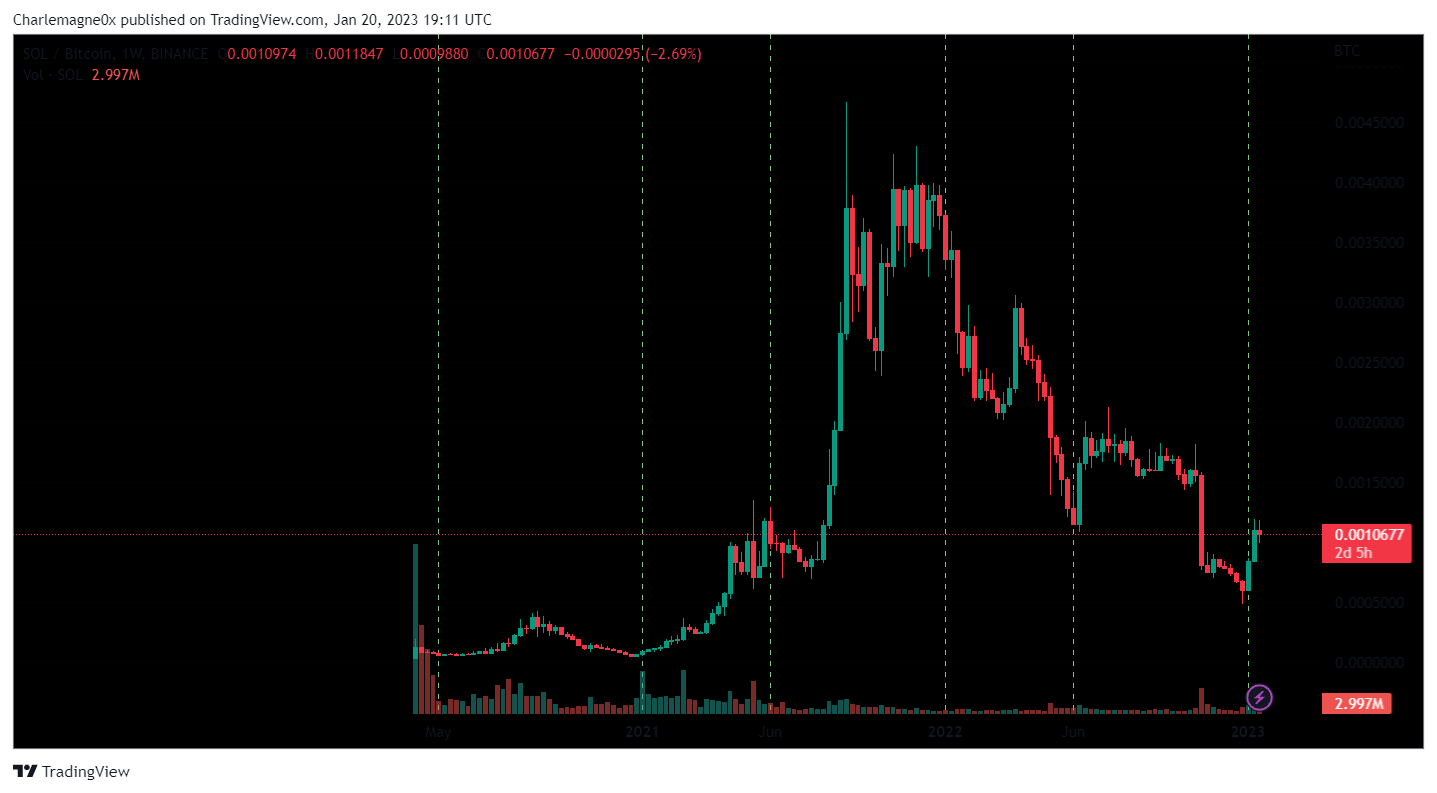

SOL/BTC

SOL/ETH

I think we have driven the point home well enough now…

Part 3: Only the Strong Survive

What makes cryptocurrency unique versus traditional finance markets is that almost all trades are transparent, and on-chain. Many large whales, funds and exchanges have their wallets doxxed and tagged via on-chain researchers. Hence, it gives us a unique look into how the VC investor class performs when the playing ground is even.

Clearly, not very well…

Cryptocurrency VCs only perform well when they are given access to early funding rounds. However, these liquid investments usually take years to bear fruit, so most either do not hedge these positions correctly or take directional bets on the cryptocurrency market in order to make a profit for LPs.

Many funds, due to a basic lack of understanding of the underlying technology of this space, made incredibly bad bets, with our friend Kyle being one of the worst, betting on two Ethereum killers in two separate massive bull markets, both of which were propped up by either suspicious or blatantly fraudulent organizations.

The overall message of this article is that crypto levels the playing ground for investors. Nepotism still does exist, however nowhere near the extent of TradFi markets. Hence, the best way to perform well against other investors in this space is to spend time fundamentally learning about the technology and making investments/trades that line up with strong emerging trends (like the scaling debacle with L2s and so forth) and not copy-trading brainlet VCs.

“I see tremendous imbalance in the world. A very uneven playing field, which has gotten tilted very badly. I consider it unstable. At the same time, I don't exactly see what is going to reverse it”

-George Soros

Well, George… we might have found the silver bullet for making the game even.

🗡️Thank you for reading our work and supporting our message🗡️