Follow up - Why Crypto VCs are Clueless

Sometimes a thesis is proven in the wild, yesterday we had that chance. A follow up with a real world example of why crypto VCs are clueless

Before reading this short follow-up, make sure you read our previous article for full context:

Introduction

We will provide a short summary if you don’t want to read the whole article above. To be blunt, the article is a brutal takedown of the performance and so-called "due diligence" of cryptocurrency venture capitalists (VCs). Kyle Samani of Multicoin Capital was used as a prime example to illustrate the shortcomings of these investors.

The article highlights the negligence and failure of crypto VCs in spotting red flags, using the FTX saga as a prime example. It's hard to fathom how these experienced investors could have overlooked the fact that the now-defunct exchange used QuickBooks for internal accounting reconciliation, which should have been a glaring issue.

Moreover, the article highlights some questionable investment decisions made by prominent VCs, such as Samani's choice to back EOS and Solana over Ethereum. The article further highlights that success in the crypto space requires a deep understanding of the technology and the ability to make one's own investment decisions based on actual trends rather than blindly following the advice of venture capitalists.

The article serves as a reminder for investors that the world of cryptocurrency provides a level playing field, and relying solely on VCs for guidance may not be the most prudent course of action. Instead, it is essential to conduct thorough research and make informed decisions. Ultimately, why would anyone want to depend on an uninformed VC when they could carve their own path to success?

Now that’s done with, let’s discuss a real-world example of this exact thesis playing out. Charlemagne, one of Vagabond’s writers, had an interesting back-and-forth with a so-called VC last week, which really hammers down just how stupid the VC class is.

Background

Before we delve in, some necessary background. Bitcoin and Ethereum have smaller units generally used to pay for gas fees. There is some semantics to this, but we will keep it simple.

1 Bitcoin = 100,000,000 SATs

1 Ethereum = 1,000,000,000 GWEI

That is pretty straightforward to understand. There are 100 million SATs in a single Bitcoin and 1 Billion Gwei in a single Ethereum.

When you send a transaction over either network, usually, the transaction fee is denominated in Sats or Gwei, because typing in a smaller unit is generally easier versus typing in a large decimal number with five or more zeros. It’s a user-experience decision to help make transactions easier.

Usually, as we will discuss below, wallets like Metamask will also show the value in Ethereum in order to help the user better understand exactly how much they are paying.

The Beef

Ok, now that we have established sufficient background, let’s dissect the beef that inspired this follow-up:

First, some background on our brainlet VC. Trevor.btc, or @TO on Twitter, is a self-proclaimed Bitcoin Venture capitalist managing a hedge fund attached to the Stacks sidechain. His Twitter description provides a good background:

“Investor in 50+ Bitcoin startups & a few ETH ones😉

Managing Partner @BTCFrontierFund

CEO @ninjalerts

#SpacesHost for @nftnow & @TheOrdinalShow”

In their own words, the "Bitcoin Frontier Fund” invests “in outstanding teams building new use cases for Bitcoin.” He also claims to invest in various Ethereum startups. You would assume someone who has invested in Ethereum startups would understand the difference between ETH and Gwei, and be able to convert between both easily. The average degen on-chain trader is an expert at this, and most are not cashed-up venture capitalists.

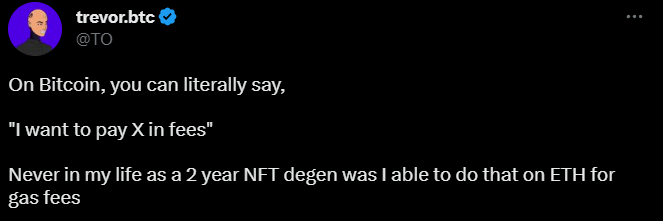

Now let’s see what this genius VC was complaining about:

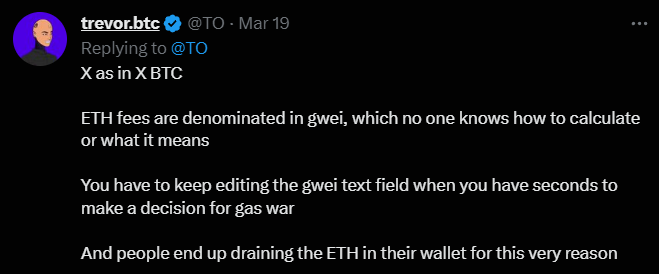

Now, just to be upfront, this statement is completely incorrect. You can absolutely edit a transaction in, say, Metamask and specify exactly how much you want to pay, as Charlemagne will point out.

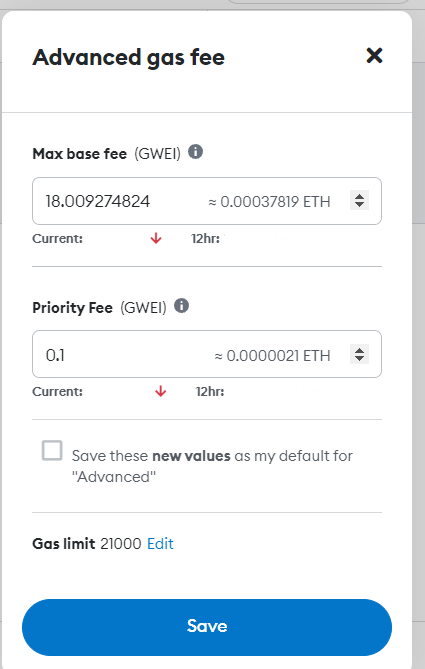

Above is the UI for editing the amount that can be paid for a transaction, with the Ethereum conversion displayed clearly.

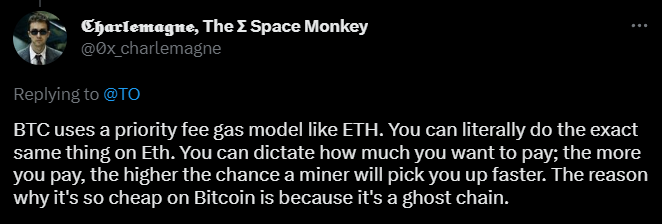

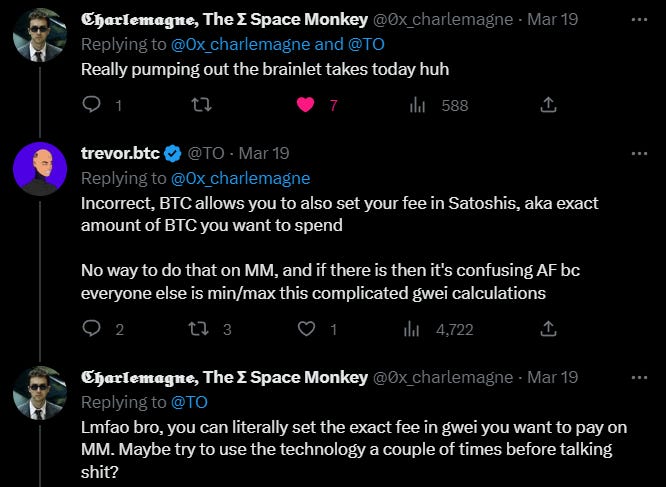

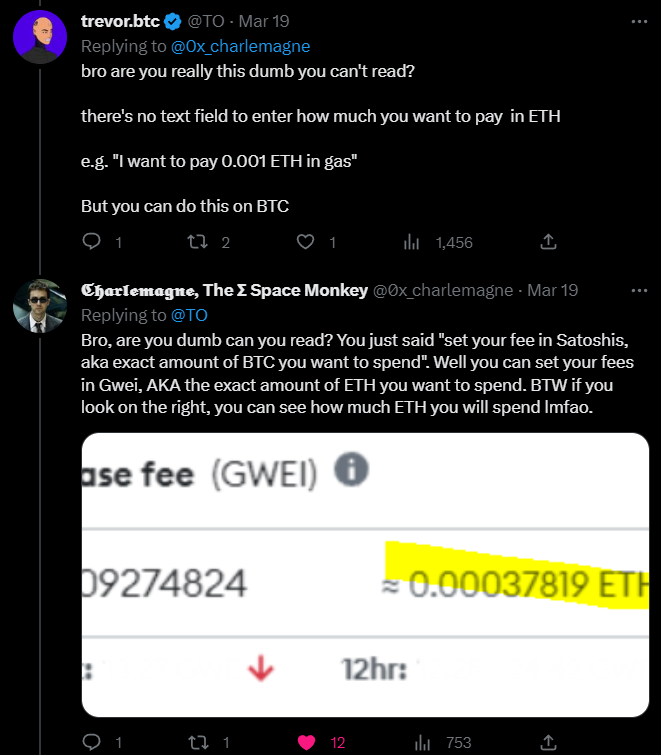

Not realizing the limits of his intellect, Trevor tries to make an Ad hominem attack. However, Charlemagne turns it back on him while correcting his understanding again.

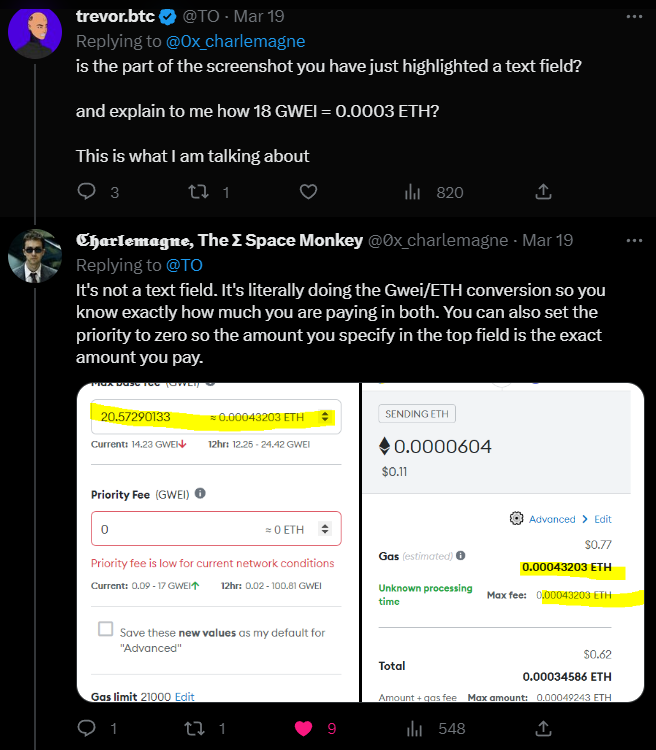

Even with a conversion shown right in front of him, Trevor still can’t figure out how much Gwei equals and how much Ethereum.

Due to a lack of basic critical thinking skills, Trevor can’t understand why wallet developers would use the smaller unit Gwei to input transaction fees. Of course, once again, Charlemagne explains it to him.

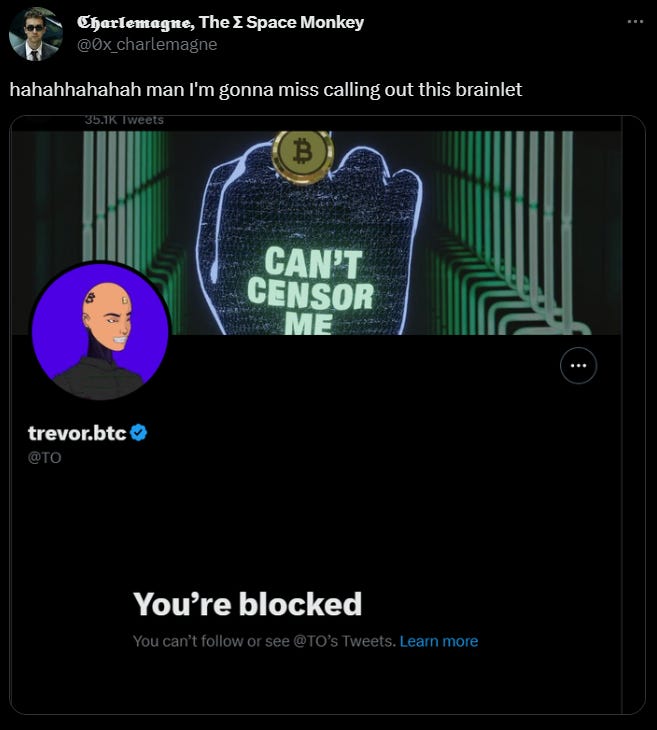

Links to the full threads below so you can read them in full context (we included screenshots because these so-called free speech-loving Bitcoin maximalists really enjoy blocking anyone who points out their stupidity).

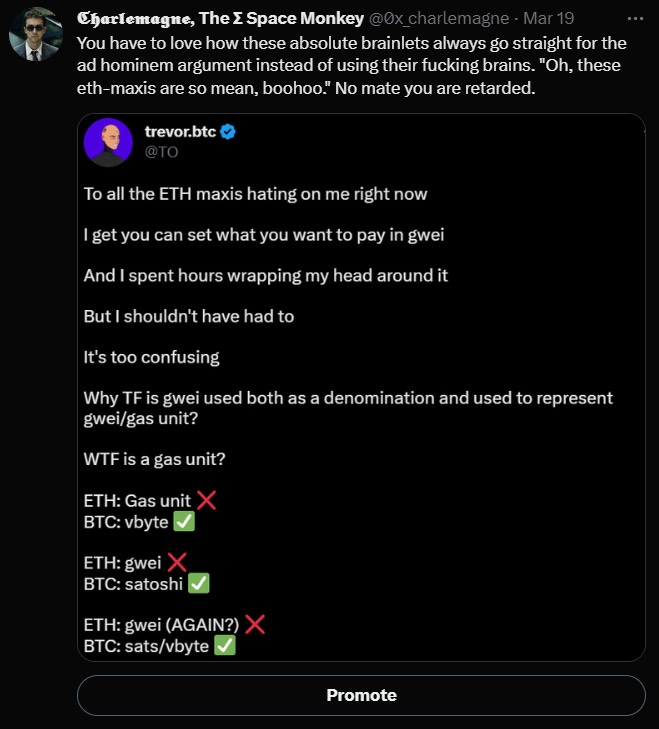

Of course, once Trevor realizes he is wrong, in typical low-IQ fashion, he goes straight for the Ad hominem:

And, of course, can’t forget this gem: (which he posted after blocking Charlemagne)

And finally, the cherry on top…

(Notice the irony in his Twitter background image)

Retrospective

There is a great quote from the Hagakure which can be used to sum up this entire interaction:

“To give a person an opinion, one must first judge well whether that person is of the disposition to receive it or not.”

― Yamamoto Tsunetomo, Hagakure: The Book of the Samurai

Venture capitalists often exhibit a lack of understanding when it comes to investing in complex and rapidly evolving technologies, including cryptocurrency. This knowledge gap can lead to poor investment choices, as VCs cannot accurately assess the potential of emerging technologies and startups. Consequently, they may end up funding underperforming or even detrimental projects, which can have far-reaching implications for entire industries.

A striking example of this phenomenon is FTX, a once-prominent cryptocurrency exchange that attracted investments from a multitude of VCs. These investors, seduced by the promise of exponential growth and lucrative returns, failed to perform adequate due diligence on the platform's underlying technology, security measures, and regulatory compliance. As a result, they inadvertently contributed to the eventual collapse of the exchange, which cost customers billions of dollars and severely damaged the reputation of the crypto industry.

The FTX debacle has had a cascading effect on the entire cryptocurrency ecosystem. Trust in the technology, and its associated platforms has been severely undermined, and the fallout has led to increased regulatory scrutiny and a slowdown in the adoption of digital assets by mainstream investors. Furthermore, the collapse has highlighted the glaring deficiencies in the venture capital investment process, particularly in the context of the crypto market.

The FTX case serves as a stark reminder of the importance of thorough due diligence and a deep understanding of the markets in which VCs invest. By blindly pouring money into ventures without adequately evaluating their potential risks and rewards, these investors can inadvertently fuel the rise of poorly-conceived projects that waste precious resources and threaten to set back entire industries by years. Furthermore, the above interaction highlights how many VCs in this space do not deserve to manage a fund, as they are incompetent and barely understand the very technology they are investing in, leading to situations like FTX and 3AC.

We at Vagabond will continue to call out these VCs who push falsehoods, scams, and misinformation to purge them from the industry so that it can grow safely, with users sufficiently protected from bad actors and the general stupidity of venture capitalists.

🗡️Thank you for reading our work and supporting our message🗡️

quickly becoming my favorite blog/news source