China Scraps Zero Covid Policy & Reopens -What this means for the World

After years of strict Covid isolation at a societal level, China is reopening its borders to the world and opening them fast

China, a country that has been the exemplar of social engineering and experimental covid policy, has finally opened its borders to the world and done away with its Zero Covid policy. However, everything happens for a reason, and after years of the trade war, tariffs & economic strife, you’re probably asking, Why now? And how will this affect me? We don’t have a definitive answer, but we sure did try.

But first;

What is the Zero Covid Policy?

China's goal in fighting COVID-19 is to keep cases as close to zero as possible. To achieve this, it has implemented mass testing, quarantined the sick in government facilities, and imposed strict lockdowns that can span entire cities. When you have a society with power squarely in the hands of central authorities, this quarantine method becomes relatively simple. This is a far cry from many Western societies, which provide a certain degree of autonomy to individual states, which usually results in vastly different Covid policies, state to state.

However, now that this policy has been reversed, the next question is why?

Economic necessity

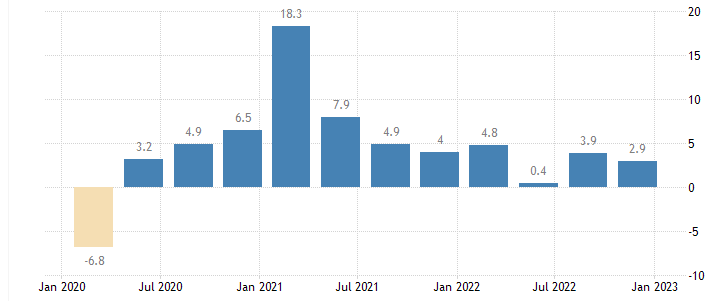

In Q4 2022, The Chinese economy expanded 2.9% YoY, easing from a 3.9% growth in Q3 but above market estimates of a 1.8% increase. A far cry from 2020, where it peaked at -6.8% during the early period of Covid.

For the full year of 2022, the economy grew by 3.0%, missing the official target of around 5.5% and marking the second slowest pace since 1976 amid the impact of Beijing's zero-COVID policy.

China, the miracle economy which elevated itself from a developing economy into the second most powerful state on Earth in the span of a few decades… had a lousy quarter. Nation-states, like publicly listed companies, seem indebted to their quarterly statements.

Foreign Direct Investment (looking elsewhere for Alpha)

As political relations soured, China withdrew capital from the rest of the world at a breakneck pace and expelled an equal amount of money from their own markets. They also cracked down heavily on the unstable Domestic Real Estate market, which relied heavily on debt.

The property market contributes to about a quarter of China’s GDP and has been a drag on growth, especially since Beijing cracked down on developers’ high reliance on debt in 2020.

China bond defaults hit US$20 billion in 2022, more than double last year’s total, with Property Developers making up the bulk of these defaults.

If we were a betting blog, it would be safe to say that China understands the need for global investment and to allocate capital in diverse markets where there can be a degree of insulation from domestic risks.

What does this mean for China’s largest trading partner in the West?

Chinese investors look across the globe for business opportunities. However, China is still going through the motions and figuring out its relationship with the United States. It has feigned interest in its historical trading partner down under.

Australia’s property market is at the top of their list according to Asian real estate tech group Juwai IQI, which forecast that Chinese investment in Australian housing would hit US$4.8 billion this year – doubling on a yearly basis from 2022’s data. Although this will bring a surplus of investment and growth to Australia, there will be increasing pressure on the local rental market, which already suffers from a chronically low vacancy rate of 1.2%.

Free movement of people as well as money

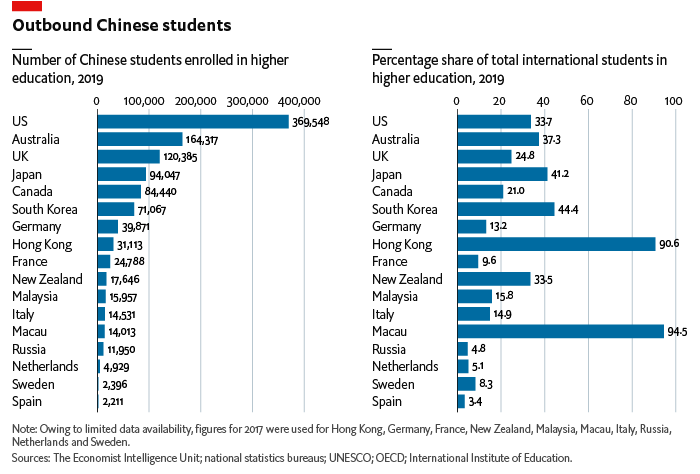

Another big announcement was from the Chinese Ministry of Education. Where Chinese students enrolled to study online with overseas providers must return to on-campus study in those countries at the start of the semester. In other words, more than 50,000 Chinese students at Australian universities have been ordered to return to their studies on campus. However, Australia isn’t even China’s largest education export.

The advantages of the reopening to the World

The graph outlines a sharper picture than words ever could. Some of the United States’ largest sectors are Education and Tourism. The United States is home to most Chinese students enrolled in tertiary education outside China. Australia, a major trading partner of China, is trailing in at second. Tourism is a natural feeding ground for a booming education market where students worldwide can study, eat, explore, and sometimes start their own families in the host country. The return of Pre-covid mandates of open borders will see a tremendous boom delivered to industries that have suffered, such as retail, hospitality, tourism, and education.

The disadvantages

However, given the speech RBA Governor Lowe gave last week, a new dynamic is at play. Suppose the Reserve Bank of Australia prioritizes curb inflation to manageable levels. What will happen when China, with billions to invest and a booming middle class eager to spend, begins to stimulate an economy in our precarious situation too early? For a summary of the Governor’s insight into Interest rate policy in 2023, read here:

Some bad, but mostly good in the long term

In summary, this is generally good news with some concerning side effects. We need our trading partners more than ever to help propel each other forward. However, we are also in a susceptible transition stage as we attempt to avoid a recession in 2023-24. The willingness of China to engage with the West is essential to regional stability. However, we need to be careful not to supercharge economic activity and inadvertently speed up the crisis we’ve been raising rates to hold off for months.

🗡️Thank you for reading our work and supporting our message🗡️