Are Coal Exports the Key to Easing Relations with China?

An analysis of what Australia can do to boost its economy via trading with China whilst keeping international relationships strong

Overnight there was backroom chatter between diplomats in China and Australia over the potential partial 20% reduction in the tariffs imposed on Australian coal exports.

This spurred nominal overnight gains with the AUD and its major pairs. The market reaction outlined a new excitement in markets that are keen for a restoration of Aus-Sino relations in 2023.

These tariffs seem like they have been going on for eons at this point, but the reality is that the markets have short-term memories.

China enforced the ban on Australian coal in late 2020 over issues including a call for an independent probe into the origins of the coronavirus.

However bad faith had been brewing even before then when the United States and Trump administration began to take a more aggressive stance against China after 2016. This followed by the ban on Chinese telecom giant Huawei in Australia only spurred on poor relations over time.

Australia, being a security partner of the United States and a major trading partner of China was stuck between a rock and a hard place.

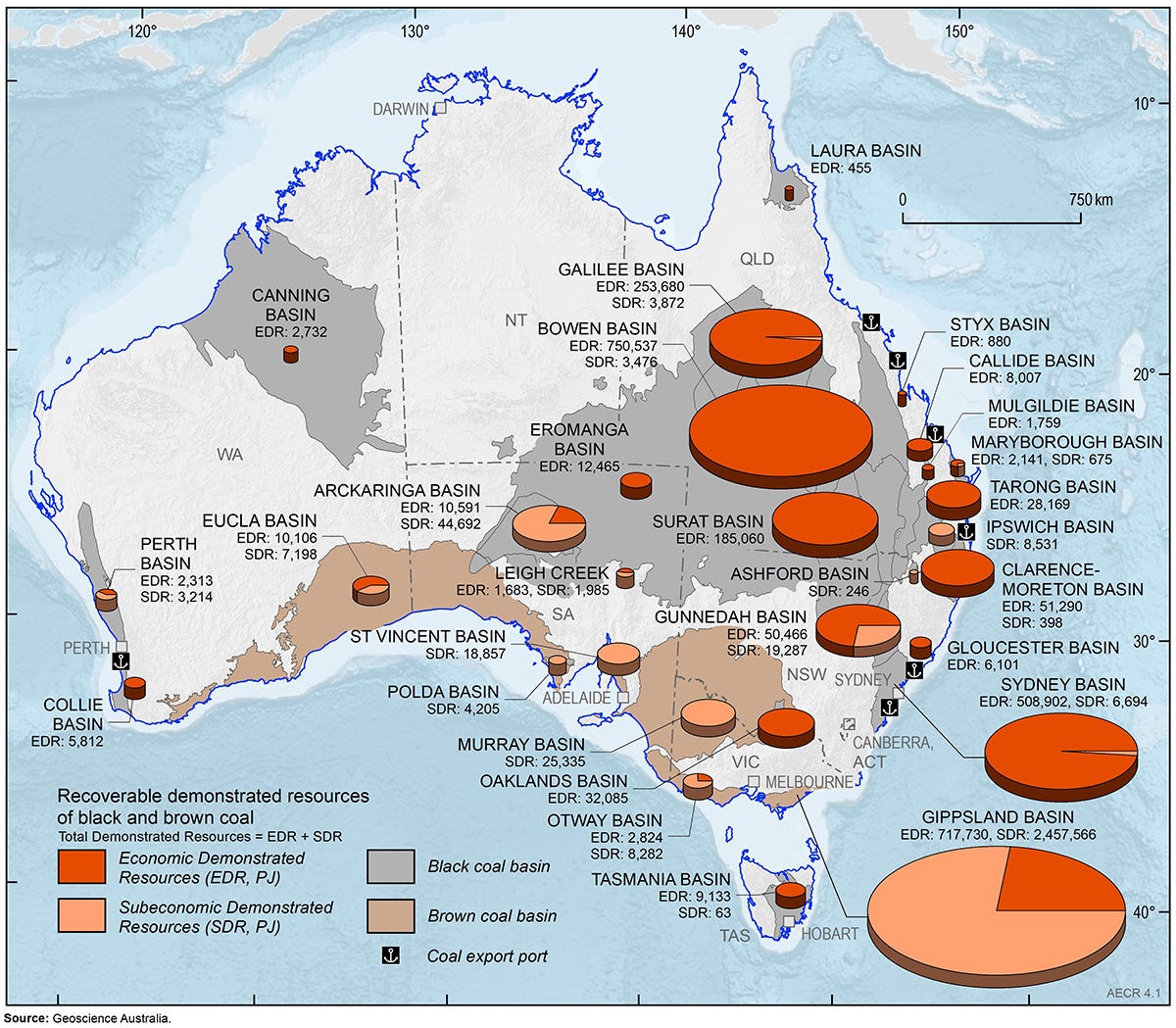

The graph above provides a general picture of the total recoverable coal locally. Whether you’re a geologist or not, it’s clear that coal is a major artery of the Australian economy. In 2020, Australia held 14 per cent of the world’s coal reserves (black and brown), ranking third behind the United States (23 per cent) and Russia (15 per cent).

With Russia now fully engaged in the war in Ukraine and finding itself on more and more global sanction lists, economies still addicted to coal need to fill a need to fuel their economies while the world makes the slow transition to clean energy.

While the exact timeline of the ban's removal is unclear, Chinese traders and end-users said three of China's state-owned power plants -- China Datang Corp., China Huaneng Group Co., China Energy Investment Corp. -- and steel producer China Baowu Steel Group Corp. have been invited by the government to import Australian coal.

Accordingly, Chinese imports of Australian coal could resume as soon as April 1.

However, coal is one of the few goods that China had banned. Wine, another major export was also hit alongside Barley with tariffs.

With COVID heavily hitting global supply chains and trade, the supercharged Interest rates around the world do little to provide comfort for most for 2023. Therefore, it is essential that what politicians can do about thawing markets, they double down.

As it is now evident, we need every dollar and cent to not just break even but to get out of the trough we find ourselves in.

Sources

Penny Wong is weaving a new regional tapestry for Australia

Trading Economics - Coal Price

🗡️Thank you for reading our work and supporting our message🗡️